Intelligent automation-enabled tools promise to offer significant operational and efficiency improvements in the middle and back office in capit…

Intelligent automation-enabled tools promise to offer significant operational and efficiency improvements in the middle and back office in capit…

The demand for and adoption of mutualized solutions are likely to grow because need for cost reduction and streamlining operations will persist…

I am looking forward to participating in a partner workshop panel at SIFMA’s Operations Conference & Exhibition this year in Phoenix on May 8th.…

Repo is THE tool to leverage for collateral management. Celent tells you how. The global repo market is ripe for change after years of stagnatio…

Everyone trades foreign exchange, and most firms are still paying very high prices to transact in a crucial part of the overall capital markets.…

We compare major front-to-back wealth management platforms using our ABCD analysis. This is the second report in our report series evaluating No…

(Source: Wikipedia, Tokyo Stock Exchange) The second chapter in the securities settlement revolution is the shortening of the equities settle…

I read a study by Broadridge and Institutional Investor this weekend that contemplates the future of capital markets. The two firms worked toget…

Cost basis reporting vendors continue to work toward compliance for 2012 and 2013 regulations. Celent expects an increased number of firms and v…

A study by Celent and sponsored by Broadridge looks at the changes in the hedge fund / prime broker relationship and how this is fostering an ev…

In May 2024, barring any further delays, the United States and Canada will be shortening their trade settlement cycles from a two-day settlement…

To help our clients navigate challenges facing the industry, Celent has developed a new, enhanced approach for tracking financial institution IT…

The announcement yesterday (October 19) that DTCC is acquiring the blockchain fintech Securrency is a resounding signal to the global financial…

Financial market infrastructures (FMIs) are the mainstay of the financial system, providing the essential infrastructure for financial transacti…

This report represents the Financial Markets Infrastructure edition of the Capital Markets Previsory 2023 report series. While FMIs are benefiti…

As I wrote about in my first Celent blog, the capital markets post-trade industry is transforming, and none too soon.In that vein, The Depositor…

The demand for applications is growing faster than the supply of developers to deliver them. A new era of low/no-code development is emerging, w…

This year, Celent interviewed 25 chief information officers and senior technology leaders of global market infrastructure (MI) to understand the…

The fallout of the Covid-19 pandemic is likely to have ramifications in a number of areas within capital markets, for example shift to remote wo…

The world had a tough 2020 but, unlike the 2008 financial markets crisis, this time capital markets emerged as the hero as governments worldwide…

A Year of Extremes… It certainly has been a year of extremes with many superlatives required to describe the situation; but also, a year with pl…

The following report provides a high-level landscape of the major vendors within the net asset value (NAV) oversight and contingency ecosystem.…

During the first half of this year, Celent conducted in-depth conversations with global asset managers about their back office NAV oversight and…

The clock is ticking for financial institutions (FIs) to adequately prepare for the seismic shift from the London Interbank Offered Rate (LIBOR)…

Treasury and capital markets divisions at banks continue to struggle with the trilemma of complying with regulatory changes and meeting evolving…

MB has enhanced its market risk and counterparty credit risk (CCR) management to meet global standards, including: A near real-time VaR calcul…

In May 2024, barring any further delays, the United States and Canada will be shortening their trade settlement cycles from a two-day settlement…

Tokenization is this year’s hot topic in blockchain, and our conversations with clients often move quickly to predicting where the breakout use…

FX is at the greatest inflection point since Nixon decoupled the dollar from gold in 1971. Foreign exchange (FX), and its technology demands, ar…

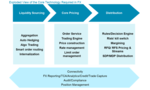

Celent explores the opportunities and challenges of the morphing sell side front office in this cross asset trading technology piece. The advent…

The clock is ticking for financial institutions (FIs) to adequately prepare for the seismic shift from the London Interbank Offered Rate (LIBOR)…

The (L)IBOR rate which we have all known and loved-then vilified and hated is going away. Regulators and market watchers saw the rate has easily…

The G-20 mandates are the gift that keeps on giving. Initial Margin (IM) is the latest installment in regulations aimed at reducing risk in OTC…

Initial margin (IM) requirements are a global regulatory regime intended to limit systemic contagion by offsetting losses if an OTC derivatives…

Repo is THE tool to leverage for collateral management. Celent tells you how. The global repo market is ripe for change after years of stagnatio…

Regulations and macroeconomic evolution are influencing profitability and return on capital altering traditional capital markets business models…

Digital technology enablement could augment alpha generation for active managers and stem the erosion against the tidal wave of passive investin…

Inappropriate conduct has cost the financial services industry a significant amount in direct losses, lawsuits, and fines since the last financi…

Celent shares prospective developments from innovative solutions and business models around shared services, utilities, and joint ventures as a…

MB has enhanced its market risk and counterparty credit risk (CCR) management to meet global standards, including: A near real-time VaR calcul…

In May 2024, barring any further delays, the United States and Canada will be shortening their trade settlement cycles from a two-day settlement…

Tokenization is this year’s hot topic in blockchain, and our conversations with clients often move quickly to predicting where the breakout use…

FX is at the greatest inflection point since Nixon decoupled the dollar from gold in 1971. Foreign exchange (FX), and its technology demands, ar…

Celent explores the opportunities and challenges of the morphing sell side front office in this cross asset trading technology piece. The advent…

The clock is ticking for financial institutions (FIs) to adequately prepare for the seismic shift from the London Interbank Offered Rate (LIBOR)…

The (L)IBOR rate which we have all known and loved-then vilified and hated is going away. Regulators and market watchers saw the rate has easily…

The G-20 mandates are the gift that keeps on giving. Initial Margin (IM) is the latest installment in regulations aimed at reducing risk in OTC…

Initial margin (IM) requirements are a global regulatory regime intended to limit systemic contagion by offsetting losses if an OTC derivatives…

Repo is THE tool to leverage for collateral management. Celent tells you how. The global repo market is ripe for change after years of stagnatio…

Regulations and macroeconomic evolution are influencing profitability and return on capital altering traditional capital markets business models…

Digital technology enablement could augment alpha generation for active managers and stem the erosion against the tidal wave of passive investin…

Inappropriate conduct has cost the financial services industry a significant amount in direct losses, lawsuits, and fines since the last financi…

Celent shares prospective developments from innovative solutions and business models around shared services, utilities, and joint ventures as a…

In May 2024, barring any further delays, the United States and Canada will be shortening their trade settlement cycles from a two-day settlement…

Tokenization is this year’s hot topic in blockchain, and our conversations with clients often move quickly to predicting where the breakout use…

Celent explores the opportunities and challenges of the morphing sell side front office in this cross asset trading technology piece. The advent…

The clock is ticking for financial institutions (FIs) to adequately prepare for the seismic shift from the London Interbank Offered Rate (LIBOR)…

The (L)IBOR rate which we have all known and loved-then vilified and hated is going away. Regulators and market watchers saw the rate has easily…

Repo is THE tool to leverage for collateral management. Celent tells you how. The global repo market is ripe for change after years of stagnatio…

Regulations and macroeconomic evolution are influencing profitability and return on capital altering traditional capital markets business models…

Fractional share trading for equities and ETFs is not new. Widespread adoption of fractionals in mostly brokerage accounts were spurred on by th…

The last four years in the financial markets have seen immense volatility, patchy liquidity, and fundamental shifts towards a new macro regime.…

On 12th June 2023 (just yesterday), Nasdaq announced their intentions to acquire Adenza (which itself was created from the coming together of Ca…

The mechanisms for trading fixed income products continue to evolve amid a backdrop of market infrastructure challenges, regulatory responses, i…

The demand for applications is growing faster than the supply of developers to deliver them. A new era of low/no-code development is emerging, w…

Last month I was honored to participate in the TradeTech FX annual conference in Miami, FL, and to assist by hosting a keynote interview and mod…

I’m extremely excited to announce my participation as a speaker at this year’s TradeTech FX Conference. The conference dates are February 16–18,…

FX is at the greatest inflection point since Nixon decoupled the dollar from gold in 1971. Foreign exchange (FX), and its technology demands, ar…

The use of AI in financial services is becoming a reality. The capital markets are fertile proving grounds for overcoming real challenges in the…

The capital markets industry is doubling down on digital transformation in 2021, and so its senior business and technology executives must quest…

The world had a tough 2020 but, unlike the 2008 financial markets crisis, this time capital markets emerged as the hero as governments worldwide…

A Year of Extremes… It certainly has been a year of extremes with many superlatives required to describe the situation; but also, a year with pl…

FicTech is reinventing the fixed income technology space with ever greater speed, with an increasing number of players addressing the issuance a…

リサーチは投資情報戦略の動力源です。投資の意思決定がより高度になるにつれ、複雑なデータフローを管理し、ワークフローをサポートし、同じチームの複数のメンバーが共同で投資調査を行うことができるようにする必要性が高まっています。 リサーチ・マネジメント・システム(RSM)は、バイサイドのフロン…

Research helps power the investment engine. With investment decision-making getting more advanced, there is an increasing need to manage complex…

For insurance and institutional clients, efficient portfolio optimization and operational agility from the standpoint of dynamic adaptation and…

OakNorth is integrating climate transition risk into portfolio risk management. ON Climate provides lenders the ability to assess climate transi…

Fractional share trading for equities and ETFs is not new. Widespread adoption of fractionals in mostly brokerage accounts were spurred on by th…

In May 2024, barring any further delays, the United States and Canada will be shortening their trade settlement cycles from a two-day settlement…

Private market asset managers were not immune from the post-pandemic, macroeconomic headwinds and recent market volatility – with operating marg…

This report is a companion piece to the Global IT report and focuses solely on North American Wealth Management IT Spending which includes Canad…

On 12th June 2023 (just yesterday), Nasdaq announced their intentions to acquire Adenza (which itself was created from the coming together of Ca…

On 27 Apr 2023, Deutsche Boerse announced a takeover of SimCorp to combine its existing data & analytics subsidiaries Qontigo and ISS under the…

As investment firms and investors contemplate how to integrate environmental, social, and governance (ESG) issues into their investing decisions…

Corporate pension plan sponsors conventionally operate in an “analog mode” where they have limited access to investment advice, with timely or r…

The mechanisms for trading fixed income products continue to evolve amid a backdrop of market infrastructure challenges, regulatory responses, i…

Profound shifts born from the wave of regulatory, capital, passive investing, and fee compression trends are continuing to alter the investment…

The demand for applications is growing faster than the supply of developers to deliver them. A new era of low/no-code development is emerging, w…

Last month I was honored to participate in the TradeTech FX annual conference in Miami, FL, and to assist by hosting a keynote interview and mod…

Driven by the imperative for sustainable cost savings and profitability, investment managers are renewing their focus to double down on their co…

Risk management technology spending is accelerating worldwide, driven by a combination of regulatory change, technological development, and macr…

MB has enhanced its market risk and counterparty credit risk (CCR) management to meet global standards, including: A near real-time VaR calcul…

The financial industry is at an inflection point, shaped by a confluence of macroeconomic forces, regulatory dynamics, and sociopolitical reperc…

Increasingly, risk offices at financial institutions are using advanced data management and artificial intelligence (AI), orchestration, high-pe…

The specialized technology that supports risk management functions has traditionally been supplied by internal development teams as well as by e…

In its inaugural year, Celent Model Risk Manager 2021 program received several high-quality nominations from a diverse mix of financial institut…

Credit Suisse’s Chief Risk Office in Asia Pacific created a cross-risk platform for risk identification and analysis across financial risk, oper…

State Street Global Advisors wanted the ability to monitor macroeconomic risks on its portfolios because it recognized the importance of underst…

The world had a tough 2020 but, unlike the 2008 financial markets crisis, this time capital markets emerged as the hero as governments worldwide…

The strategic importance of value adjustments (XVAs) and counterparty credit risk (CCR) management continues to be in the forefront of capital m…

This year, COVID market turbulence saw significant losses from capital markets participants, especially dealer and regional banks, associated wi…

Within the domain of capital markets trading, investing, structuring and risk management, next generation technology and emerging digital approa…

Celent explores the opportunities and challenges of the morphing sell side front office in this cross asset trading technology piece. The advent…

The clock is ticking for financial institutions (FIs) to adequately prepare for the seismic shift from the London Interbank Offered Rate (LIBOR)…

March Madness: Month 1 of Covid-19 A brief look at the end of the beginning from a trading and communication perspective. A look at how trading…

Traditionally, the reconciliations process and technology have been seen as a "back-office" problem and have not received sufficient investment.…

Reconciliation is a critical part of capital markets operations because the inability to get it right can result in business losses, suboptimal…

Intelligent automation-enabled tools promise to offer significant operational and efficiency improvements in the middle and back office in capit…

Just got back from the FTF Sec Ops Conference in Boston. Front-to-back asset management workflow was the main focus of the conference with some…

With its ability to analyze vast amounts of data, identify patterns, and make intelligent predictions, AI has rapidly been adopted across the ba…

While artificial intelligence has been selectively implemented to help banks fight financial crime, recent breakthroughs in AI technology promis…

Moving Ahead with GenAI It’s hard to believe how quickly Generative AI (GenAI) technology has gained traction across industries worldwide. Since…

Is that a shocking headline? Clickbait? Last month I had the pleasure of attending the AWS Financial Services Analyst Summit, followed up by the…

Celent recently published the Dimensions: IT Pressures and Priorities report series. This annual survey of bank executives worldwide is used to…

GenAI has rocketed from moonshot to reality. To flesh out the reality in the financial services industry, Celent surveyed executives in roles ti…

About the Showcase Gen AI is the hottest topic in the industry right now. Insurers are reaching out daily with questions and the need for advice…

As insurers look to take advantage of powerful new artificial intelligence (AI) capabilities, they need to modernize and expand their existing d…

This report represents the second in the 2-part series “The New Wealth Management Paradigm – From Apps to Agents.” The wealth management industr…

For many years Microsoft Excel was the staple application of finance teams. Perhaps one of the earliest “no-code” solutions, the combination of…

We recently held our first insurance executive roundtable event of the year, at our offices in New York. In attendance were 35 executives from t…

Just as COVID-19 provided the “aha” moment for accelerating digital transformation in the insurance industry, generative AI (Gen AI) is the “aha…

Last week the Celent corporate banking team published its annual Technology Trends Previsory: Corporate Banking 2024 Edition which can be downl…

The intersection of P&C insurance with Generative AI and Large Language Models (LLMs) signals a transformative shift in the industry. "Beyond Hu…

The life insurance vertical stands at a pivotal juncture with the advent of Generative AI and Large Language Models (LLMs). "Beyond Human Intell…