Celent’s recent analysis of the US market opportunity in Credit Card-as-a-Service (CCaaS) identified a busy landscape of providers offering or rapidly building the required capabilities (see The Siren Song of Credit Card-as-a-Service: In Search of a Breakthrough Opportunity in the US Market). As a follow up, we wanted to zoom-in on the “next-gen” issuer processors to deeper understand their priorities and capabilities around credit processing in the US.

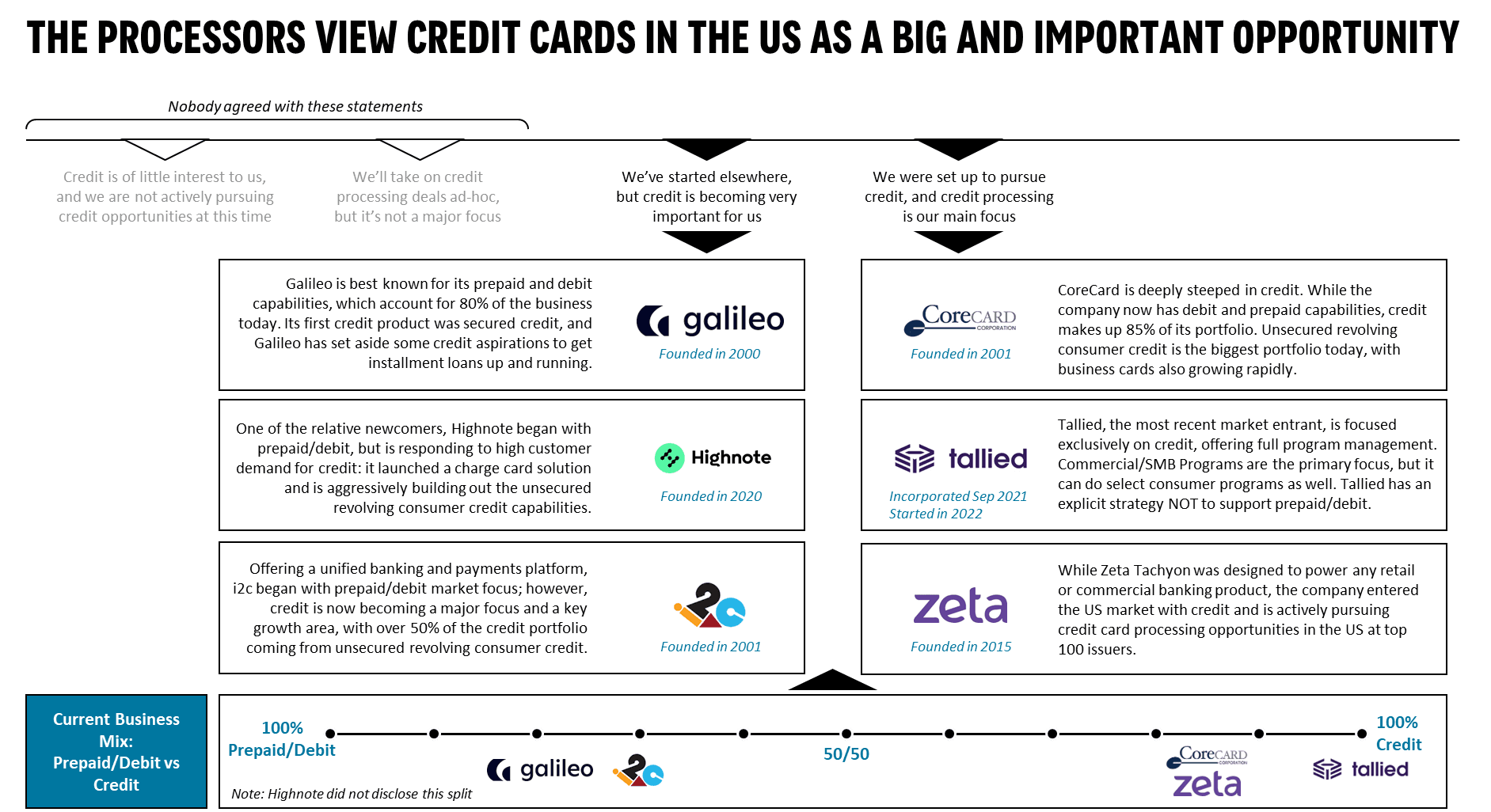

This research study is unique in the market. It includes in-depth profiles for six issuer proccessors, listed alphabetically: CoreCard, Galileo, Highnote, i2c, Tallied, and Zeta. In addition, Marqeta and Stripe are represented with short mini-profiles and, generally, are not included in the analysis. We are very grateful to all participating firms for their time and insights.

While all the companies are sufficiently similar to be called “next-gen issuer processors,” there are important differences in their focus areas and capabilities. The aim of this research has been to objectively represent each participating company, seeking to highlight the points of differentiation, rather than evaluate or “identify the winners.”

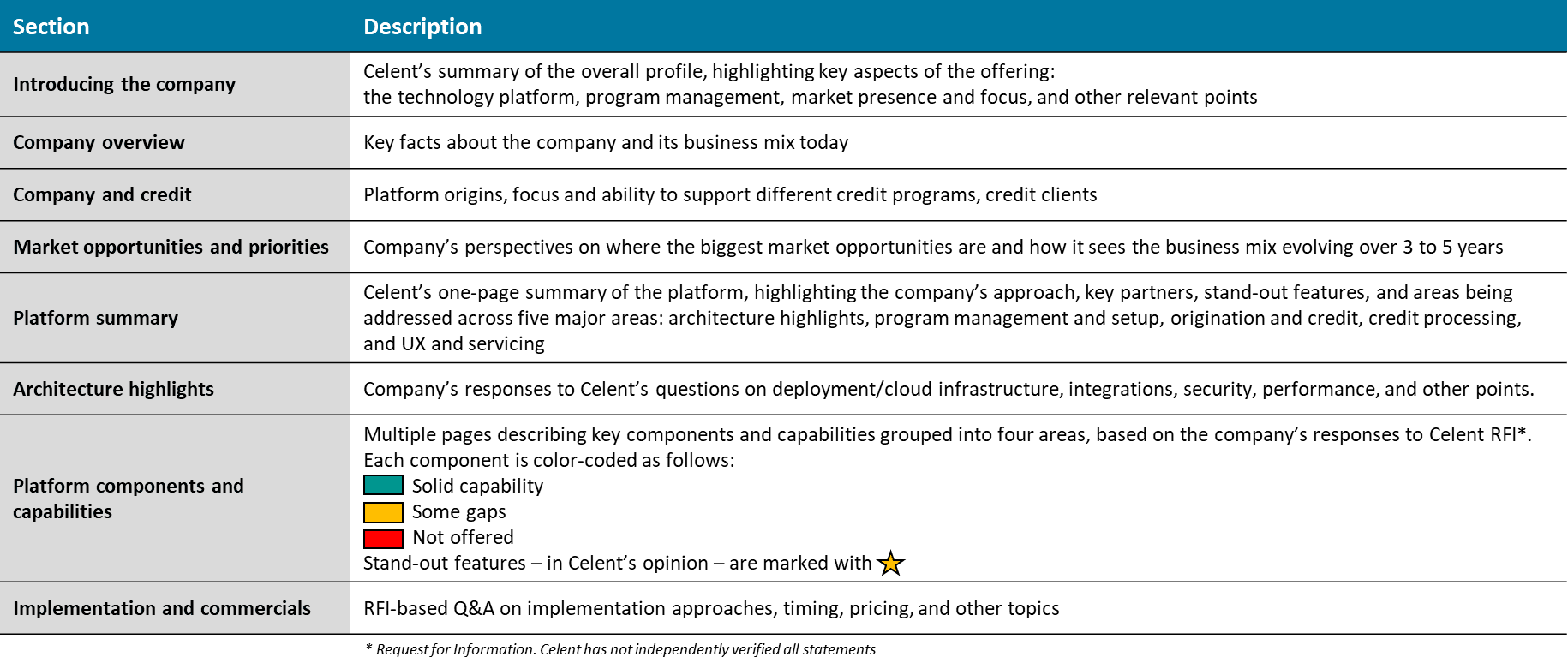

The detailed profiles are 15-35 pages each and follow the same structure:

These detailed profiles are preceded by two sections. The first looks at how the companies view the credit processing market opportunity with both banks and non-banks. The second analyzes the individual processor responses and draws out key commonalities and differences in areas such as the use of cloud, program management capabilities, core credit processing, customer engagement and servicing, and approach to pricing. An example analysis from these sections is shown below:

Many US banks that issue credit cards are happy with their existing arrangements, using either home-grown applications or outsourcing it to scale processors. However, for any bank that is considering a change, next-gen processors can provide an increasingly viable alternative. Collectively they bring exciting new capabilities to the market, and intend to disrupt the traditional credit card processing at banks, as well as capture new credit card-as-a-service opportunities with non-banks.

Related Research:

The Siren Song of Credit Card-as-a-Service: In Search of a Breakthrough Opportunity in the US Market

May 2023

Modernizing the US Card Processing Platforms: Stories of Digital Transformation

June 2022

Credit Risk Management in Banking: A Primer, Playing Defense and Offense for the Next Normal

July 2022

Is This the “End of History” Moment for Bank Card Issuers? Leading in the Disruptive World of Cards

March 2022

MONETA Money Bank: Transforming Cards with a SaaS Solution

March 2022

Pinnacle Financial Partners: Credit Card Issuing-as-a-Service

March 2022

Saving the Planet with Sustainable Card Programmes: How Retail Banks Can Help Fight Climate Change

August 2021

Ensuring Payment Systems Resilience: Mission Critical, Not Mission Impossible

June 2021

Demystifying Embedded Finance: Promise and Peril for Banks

April 2021

State of Digital Lending: Automation is Accelerating

April 2023

Experian Boost: Using Open Banking to Enhance Credit Decisioning

May 2023

How Banks and Credit Unions are Solving the Digital Value Puzzle

August 2023