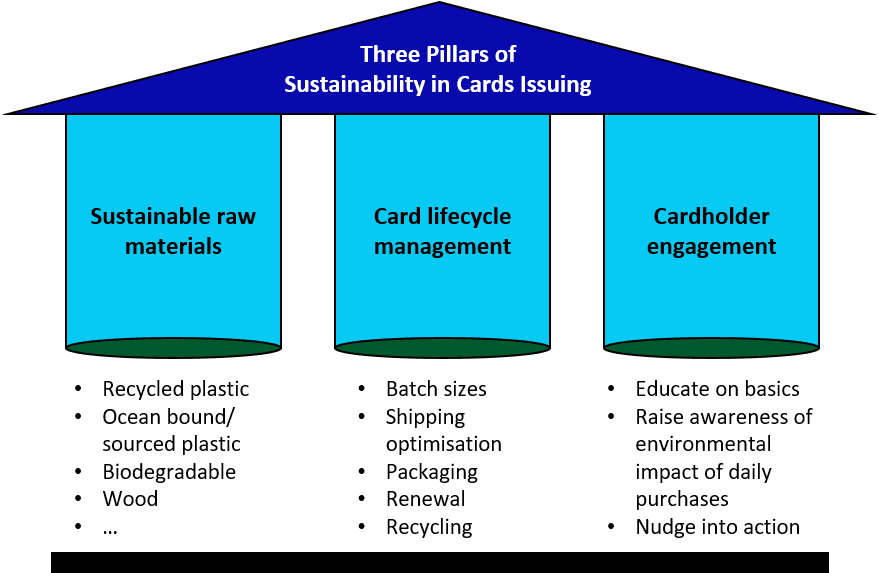

気候変動は現実であり、リテールバンクには、この問題への取り組みをサポートするという重要な役割がある。カードイシュアーは、決済カードの原材料をよりサステナブルなものに変え、カードのライフサイクルを見直し、カード所有者に情報を示して行動を促すことにより、貢献することができる。そうすることで、サステナブルなカードプログラムに取り組んでいる先駆的企業は、消費よりもサステナビリティを重視した決済という、決済をめぐる新しい用語も具現化しつつある。

本レポートの読者は、以下について学ぶことができる。

- なぜ銀行にとって気候変動が取締役会レベルの議題となっているのか、そして銀行は気候変動ついてどのような取り組みを行っているのか

- なぜ物理的なカードが今も重要なのか、そして銀行はカードを使ってどのように差別化を図っているのか

- カードが環境に及ぼす影響

- カードプログラムをよりサステナブルにする方法と、それを支援できる業界プレーヤー

- 先導的企業 (すなわち、サステナブルなカードプログラムに着手している大手イシュアー)と、こうしたプログラムを採用する動きが急速に拡大している理由

- 金融機関においてサステナブルなカード戦略を構築する方法。

必要なのは、気候変動が現実であると納得させることではなく、私たち全員が行動を起こすことである。本レポートで取り上げている先駆的企業は、リテールバンクをはじめとするカードイシュアーの今後の道筋を示している。今こそ、すべての金融機関が取り組みに参加すべきだ。顧客と従業員の幸せと関与を高めるだけでなく、地球を救う機会ももたらすことができる変革の取り組みはそう多くはないのだから。

本レポートで取り上げた認可済み金融機関:

Ålandsbanken, American Express, Bank of the West, BBVA, BNP Paribas, Chase, Credit Agricole, Emirates NBD, HSBC, Länsförsäkringar Bank, Nationwide Building Society, NatWest, Nordea, Revolut, Santander, Standard Chartered, Starling Bank, Triodos Bank, US Bank

本レポートで取り上げたフィンテックとテクノロジー企業:

Apple, CoGo, CPI Card Group, Doconomy, FIS, Fiserv, Giesecke + Devrient, IDEMIA, Klarna, Mastercard, Nets, Novus, Thales, TietoEvry, Tomorrow, Treecard, UnifiMoney, Venmo, Visa