Embedded finance is a burgeoning space with the potential to dramatically reshape the way customers engage with financial services. And yet, different things get labeled embedded finance, causing confusion, while much of the industry’s discussion focuses on disruptors rather than banks.

The purpose of this report is to help financial institutions navigate this new territory. We propose our definition of embedded finance, discuss the technology enablers, provide examples of how banks already engage with embedded finance, and offer guidance for banks wishing to pursue this model.

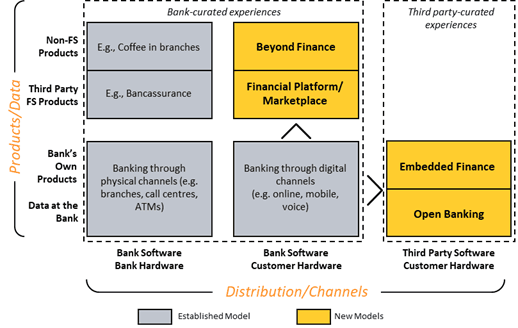

Celent defines embedded finance as the discovery and acquisition of tailored financial services products at the point of need within the digital experience curated by a non-bank third party. Embedded finance is one of four new major models of how banks can participate in an increasingly open financial services ecosystem (see Figure below).

We recognize that enabling third parties to provide financial services is not a new phenomenon, and the last thing we want is to appear too precious about the definitions. And yet, we believe that precision matters. While making FS products available to use seamlessly at a third party can lead to fantastic customer experiences (e.g., storing a card on file with Uber or Netflix), the capabilities the bank needs to deliver modern embedded finance are qualitatively different.

Similarly, while embedded finance is sometimes used interchangeably with Banking-as-a-Service (BaaS), the two are distinct. BaaS describes one of the main approaches to deliver embedded finance. In other words, embedded finance is the “what”, and BaaS is often, although not exclusively, the “how”.

As the market begins to move, financial institutions need to consider what embedded finance means to them, why they might want to participate (or not), and if so, how. While there are risks associate with this business model, the biggest risk to banks may be doing nothing at all: early movers are likely to secure the most lucrative partnerships and gain valuable experience, cementing their competitive advantage.

It remains to be seen how big the embedded finance opportunity turns out to be. We are not yet ready to pronounce the death of the traditional banking model of banks selling proprietary products through own channels. However, there is no doubt that the financial services ecosystem is becoming increasingly open. Each institution needs to determine what role they want to play within that ecosystem and whether embedded finance is the right strategy for them.

If you're not a client, please download a free report sample.

Licensed financial institutions mentioned in the report include:

Ant Financial, Banco Davivienda, Barclays, BBVA, BNP Paribas, CBW Bank, Citi, comdirect Bank AG, Cross River Bank, DBS Bank, Evolve Bank and Trust, Fidor Bank, Goldman Sachs, Green Dot Bank, Huntington National Bank, JB Financial Group, Lincoln Savings Bank, Monzo, NatWest, Paytm Payments Bank, PNC, Revolut, RBC, Seattle Bank, SFCU, Société Générale, Solarisbank, Standard Chartered, Starling Bank, Sutton Bank, TD Bank, The Bancorp Bank, WebBank, Wells Fargo, Westpac, Yes Bank

Fintechs, enterprises, and technology firms mentioned in the report include:

10x, Affirm, Afterpay, Apple, Autobooks, Beam, BitStocks, Bond, Branch, Chime, Dave, Deserve, Doordash, Empower, Facebook, Finastra, FIS, Fiserv, Galileo, Google, i2c, Jack Henry & Associates, Klarna, LightningAid, Mambu, Marqeta, Modulr, MoneyLion, MuchBetter, Netflix, Nium, PayKey, PayPal, PelicanPay, Plaid, Plum, Railsbank, Raisin, Sage, Shopify, SocietyOne, SoFi, Stripe, Synapse, Telefonica Germany, Temenos, Tesco, Thought Machine, Treezor, TrueLayer, Uber, Xero