Life Insurance Online Self-Service: Can You Go It Alone?

Abstract

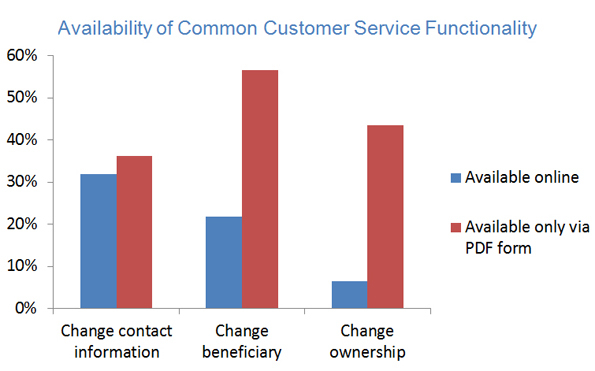

Celent has found that life insurance and annuity websites fall short in offering customers self-service opportunities on their websites.

It has only been in the last few years that life insurers have begun to offer service experience options beyond a call center or snail mail to customers. Until recently, very few life insurers offered any kind of self-service on their websites or offered mobile apps or mobile-enabled websites.

In the report Life Insurance Online Self-Service: Can You Go It Alone? Celent examines how aggressively the life insurer segment is pursuing customer self-service on the Internet through a review of the top 50 life individual retail life insurance and annuity product websites. This report looks at a customer’s ability to perform over three dozen self-service functions.

“The time is now for insurers to adopt a forward-looking perspective,” says Karen Monks, an analyst with Celent’s Insurance practice and author of the report. “Insurers should focus on ensuring their systems are capable of multichannel delivery and creating real digital relationships defined by client loyalty. Online service requires integrating mobile, web, and call center platforms and keeping all the channels in sync with new products and state regulations. It’s not a small endeavor, but it’s an imperative.”