新規顧客獲得の競争が益々激化する中で、保険会社は商品による新しい差別化の方法を探し続けている。保険会社は常に画期的な商品を開発し、それらをタイムリーに市場に出し、リスクを管理する必要があった。それらは市場シェアを拡大し、収益性を維持するための重要な要素である。

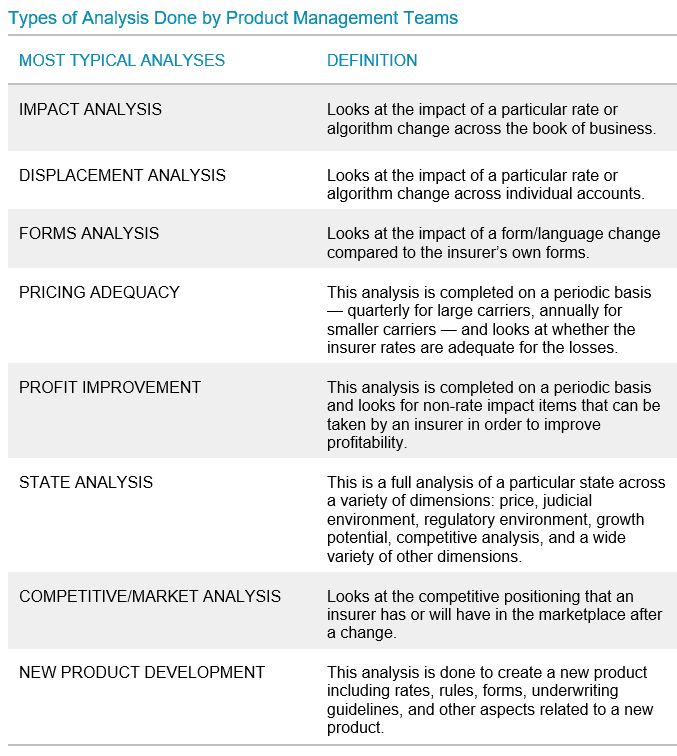

しかし、新しい商品の開発は差別化の一部でしかない。商品のISO規格改訂への準拠は進行中の問題である。なぜならISOからは毎日改訂が発表されるからだ。レートやルールの修正を効率化するツールはあるが、プロダクトマネージャーの仕事の大半は、提案された変更が市場においてどのように影響するか確認することである。レート変更による影響の大きさは?発表された新しいレートに比べた偏差は?レート変更の競争/市場への影響は? 特定の商品のレートを基準に従って評価する方法は?最も利益の高い商品はベストレートであるか?

本レポートでは、これらの質問をじっくり考える際に、保険会社が抱えるいくつかの課題を検討し、それらの課題に対処するために保険会社が利用するツールや方法について考察している。