Despite challenges posed by the macroeconomic environment, North American (NA) retail bank technology spending will grow by 3.5% in 2023. The high-level themes behind this vary between countries and financial institutions, but replacing legacy systems, maintaining compliance, and delivering greater organizational agility are the standout topics. Closely linked is the emphasis on enhancements to the customer experience in key workflows such as onboarding. In addition, projects to explore opportunities in BaaS, open banking, and embedded finance are now commonplace.

The focus on agility is particularly noteworthy. There are many factors underpinning this, but one of the most fundamental is the cultural change that has been catalyzed by the growth of fintech. Banks are increasingly open about their desire to become more responsive and nimble, and recognize that they need to adapt their approach. The pace of the adoption of cloud technologies, surge in activity around AI, including experiments with GenAI, and investment in open ecosystem projects all highlight the scale of this shift in attitudes.

To shed light on the strategic and product-level technology priorities of the industry, Celent has once again run its Technology Insight and Strategy Survey. In capturing the insights and opinions of 228 senior executives across Retail Banking globally, we have a granular view on the leading technology priorities for the year ahead, as well as the products and processes that will see the greatest change. In this report, we analyze the responses from 50 Retail Banking executives in North America (US and Canada).

Selected key findings include:

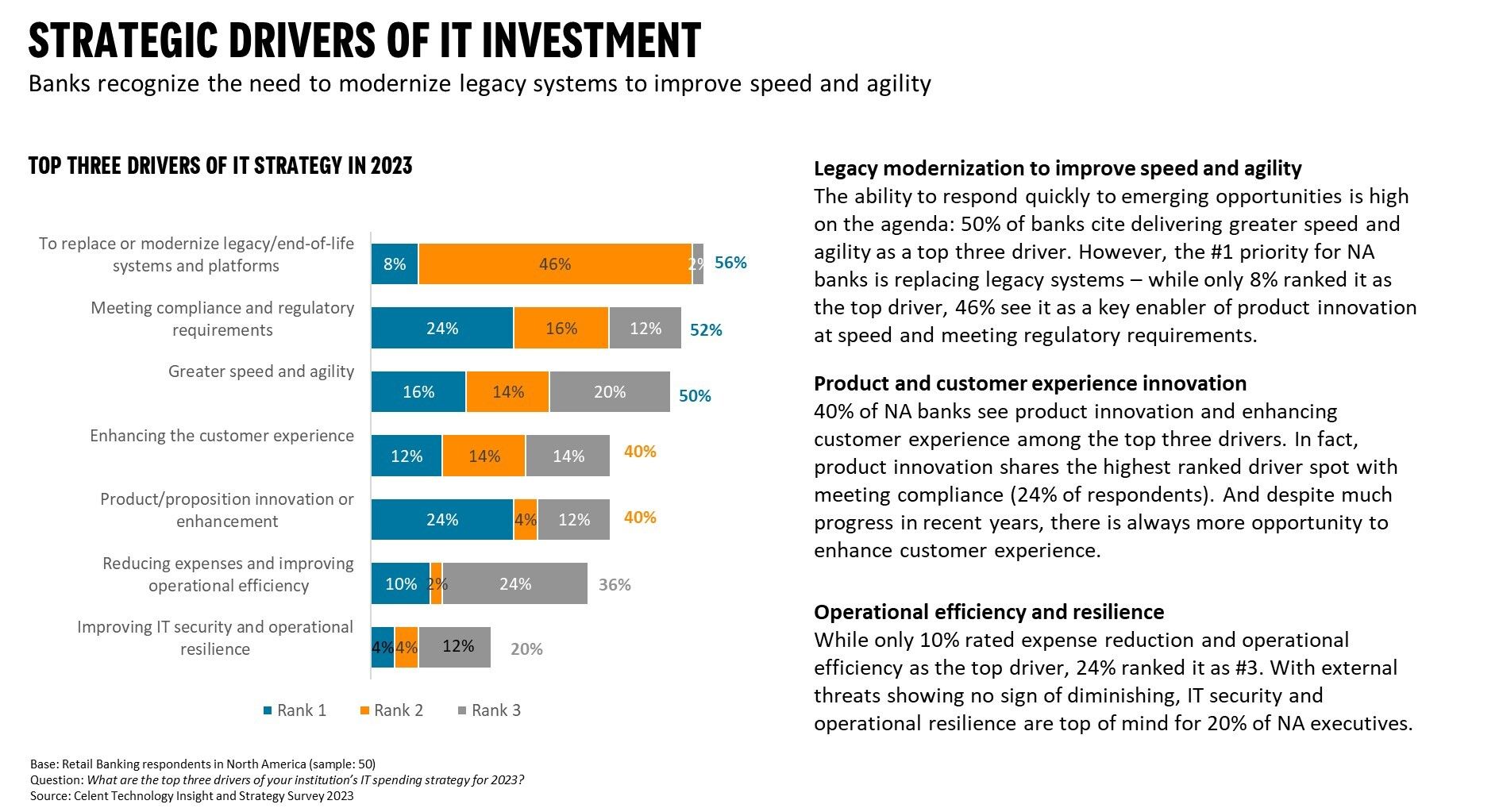

- North American retail banks recognize the need to replace or modernize legacy systems: 56% of banks ranked it as one of the top 3 drivers of IT investment. However, while banks in the US are preoccupied with legacy replacement and meeting compliance and regulatory requirements, 82% of respondents in Canada ranked enhancing customer experience as one of their top three strategic drivers, closely followed by greater speed and agility (71%).

- The gap between “haves and have nots” is growing. Even though the smallest banks are seeing the biggest increase in IT budgets, going from 3.3% growth last year to 4.9% increase in 2023, the largest banks (above US$100 BN) are also ramping up spend growth from 1.9% to 3.1%. Furthermore, the largest banks are also able to allocate the largest share (56%) to ‘change the business’ initiatives.

- 72% of retail banks in NA state that they "have a clear strategy to engage in the open ecosystem”, highlighting the pivot many are making in their product and distribution strategies.

- Two of the top 3 and three of the top 5 technology priorities are related to artificial intelligence (42% saying it’s a top 3 priority), robotic process automation (34%), and advanced data analytics and machine learning (26%).

- Generative AI is high on the list of emerging technologies with which banks are experimenting. 46% of NA retail banks are currently using or evaluating Gen AI, while a further 32% have projects using this technology in their 2023/4 roadmap.

- 68% of retail banks in NA state that “we will move more of our workloads to the public cloud in 2023”, just below the global average of 70%.

The lessons for the industry are clear. Getting rid of legacy and freeing up funds for innovation are major strategic drivers for banks in North America. Those that do not keep up with investments risk falling behind the market.