パンデミック後の環境において、マクロ経済状況と規制の動きに社会政治的な影響が重なったことで、金融業界は転換点を迎えている。嵐のような状況とは別に、未来志向のベクトルによって、サステナビリティ/ ESGアジェンダ、デジタル資産、継続的な市場のデジタル化への移行が加速している。そのため、金融機関はより積極的かつ迅速な方法で、こうした変化に伴うリスク、脅威、機会に立ち向かう必要がある。多くの場合、金融業界のリスクリーダーと最高リスク責任者(CRO)は、これらの変化の中心に立たされている。

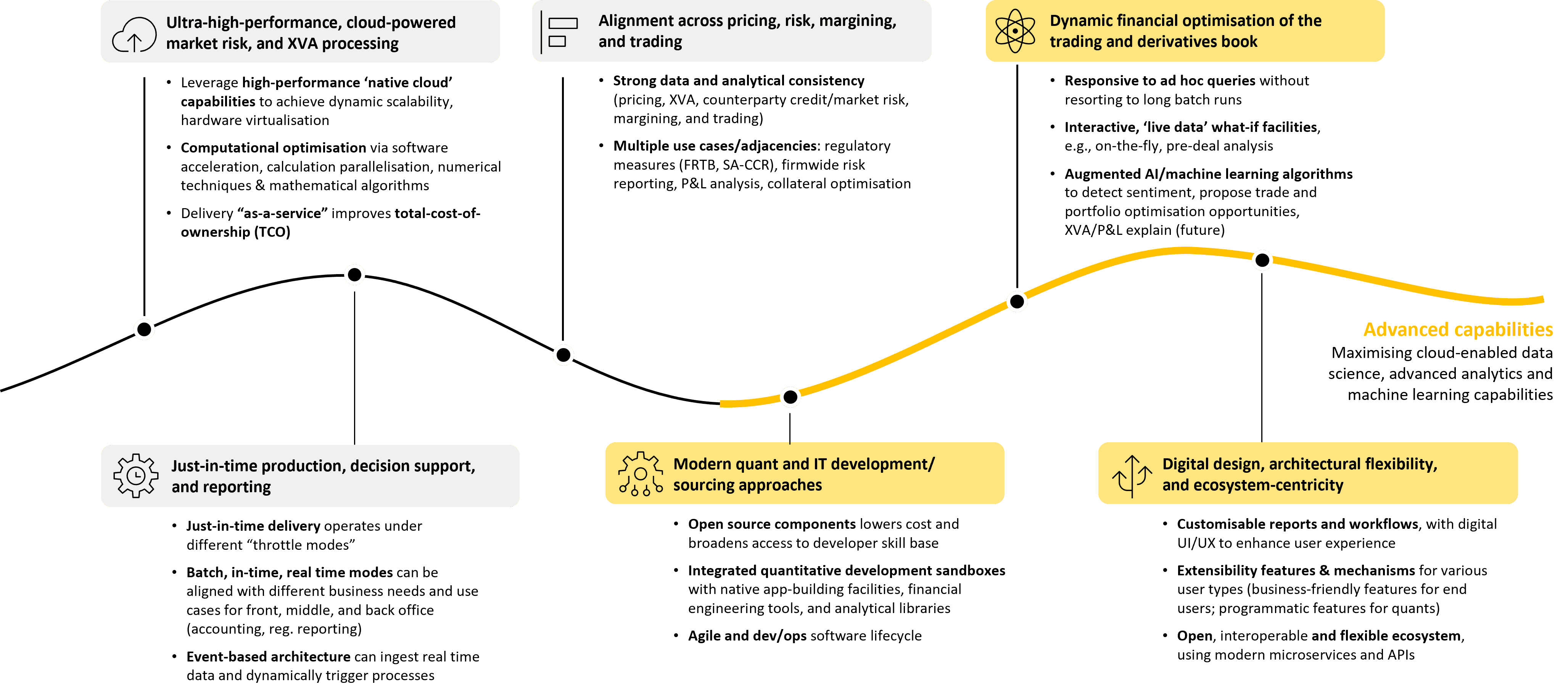

次世代のリスク機能には、さまざまなスキルセットと組織内コラボレーションモデルに加え、よりダイナミックなデータとテクノロジーのイネーブルメント戦略が必要になる。こうした戦略には、組織の応答性、リスクインテリジェンスのスピード、企業とリスクユーザーのエンパワーメント、適応の加速と管理、イノベーションの傾向、リスク管理テクノロジーエコシステムの将来に備えた準備など、リスク部署がデジタル時代の目的に適合するために新たに課せられた要求が反映されている。

将来的には、エコシステム主導のアプローチは、金融機関がプラットフォームサービスをベースに購入と開発の両方を行う上でより多くの道を開き、市場への有機的なルートと無機的なルートの融合から恩恵を得ること(すなわち「両方の長所を組み合わせること」)を可能するものである。金融機関はベンダーエコシステムを最大限に活用し、「開発か購入か」、「標準か最良か」の、より最適な成果を目指すことができる。

本レポートでは、戦略的に重要な要素を紹介し、目的に合ったソリューション戦略と卓越したテクノロジーの実現を目指す金融機関に、将来のテクノロジーとデータ活用の機能基準を上回るための戦術的な視点を提供する。キャピタルマーケッツの金融機関が次世代オペレーション機能を検討する中、競争と規制の圧力が、市場と取引先のリスクデータおよびプラットフォームに関する産業化の課題を推進し、新しい金融エコシステムの基準を満たすために必要なインフラとプラットフォームの機能に対する要件が強化されると思われる。この動きはすでに始まっているが、依然として金融機関全体が、情報提供のバリューチェーンの多くの部分に生じている成熟度の格差に対処する必要がある。

セレントの予測では、ダイナミックなAPIとマイクロサービスの「glueware」を備えたクラウドスタックを活用する次世代の機能は、専門家の要件を変更・増加する柔軟性を高め、さらなる標準化と一貫性に向かう(例えば、金融機関全体でリスク指標を共有する)と思われるが、金融機関は引き続きサードパーティのサービスを通じて程度の異なる「最良」の機能とカスタマイズを追求することも可能であろう。

キャピタルマーケッツの金融機関や投資会社がどのように業務およびテクノロジーをアップグレードしているか詳しく知りたい場合は、こちらからセレントにお問い合わせいただき、セレントの最新レポートをご覧ください(セレントのサブスクリプション会員の方は、リンク先から各レポートの全文をご覧いただけます)。