The strategic importance of value adjustments (XVAs) and counterparty credit risk (CCR) management continues to be in the forefront of capital markets firms during volatile trading and uncertain financial conditions. More than a decade on since the last credit crisis, the financial industry is facing new challenges in the coming decade, with pandemic-driven crisis conditions and continued regulatory reforms. The XVAs are a family of valuation adjustments reflected in the pricing of derivatives trades, to incorporate the costs of hedging, funding, collateral margins and capital into trades, and to take into account incoming regulatory rules such as Basel III leverage and liquidity ratios that also shape pricing decisions.

Over the years, dealer banks are balancing a pragmatic tightrope of needing to reflect these additional costs into how they price trades with client counterparties, including XVA components such as counterparty risk (CVA), own-default risk (DVA), funding (FVA), capital (KVA) and margin (MVA) in order to minimize the mispricing of trades, yet remain competitive in winning deals with prospects.

XVA management practices have advanced considerably in scope and depth. Technologies are advancing to bring on new possibilities and opening up avenues for more firms to deploy and manage XVA technology across front, middle, and back office in a faster, more accurate, and more consistent manner. The intensity of large-scale and complex simulations associated with XVA exposure measures and sensitivities to market data requires the performance of calculations and production runs to be highly optimal. Current performance frontiers are addressed through a combination of software acceleration, numerical algorithms, mathematical optimization and hardware infrastructure boosting approaches. These will enable financial market participants to deploy efficient XVA "factory" infrastructures at scale, manage capital and optimize margin impact to portfolios.

Technology and solutions landscape

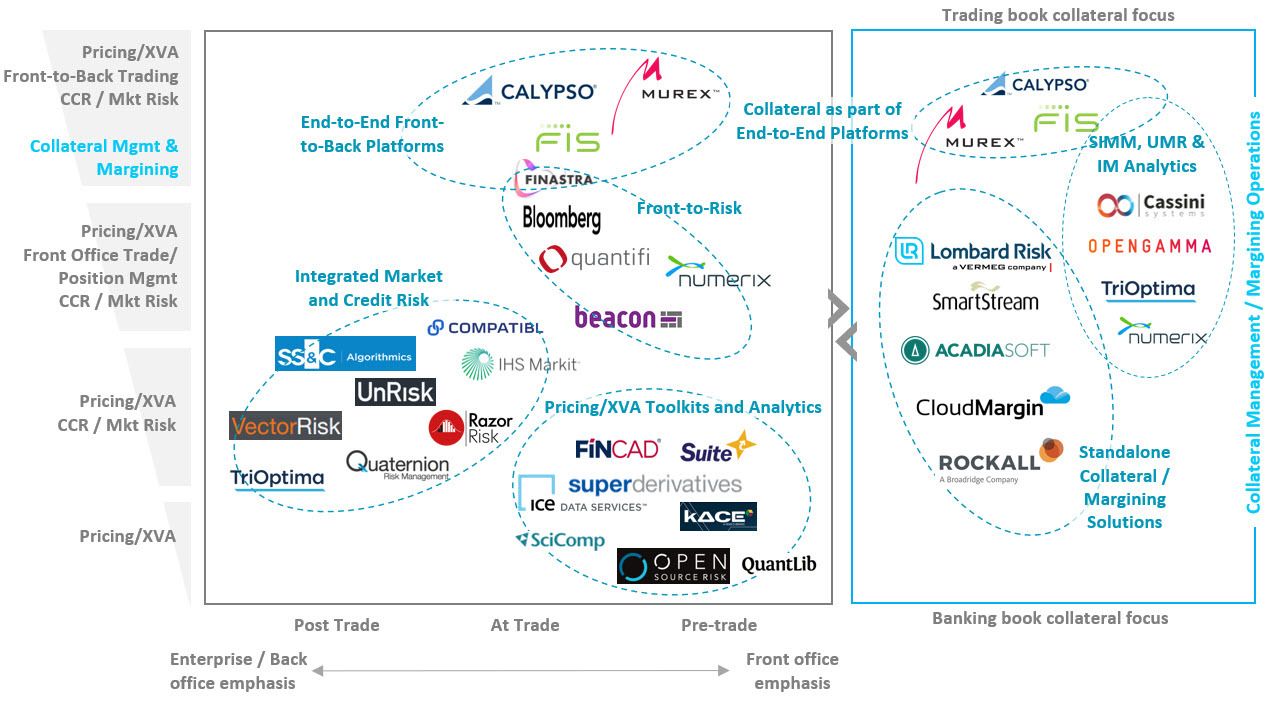

The landscape for solutions is diverse, but increasingly converging towards a fuller end-to-end offering to cover more parts of the XVA management value chain. Commercial solutions vary in product coverage, functional scope, depth, and the breadth of XVA metrics available, delineated along a number of distinct but interrelated dimensions: Coverage of financial assets/ instruments, types of XVA measures and delivery mechanisms, performance capabilities, client segment / use case focus, and breadth of functionality across adjacent domains related to XVA's chain of activity.

Celent expects several technological dynamics associated with the next-generation solutions to shape distinctive capabilities and create new opportunities. In the years ahead, we anticipate that end-user demand and vendor ecosystem for XVA solutions will continue to evolve as a result of next generation technology stacks, greater access to computing power natively via the cloud, opensource components, and "platformication" effects. Forward-thinking firms now have a real opportunity to build better decision support capabilities, drive new levels of cost efficiency, and improve operational performance.

In this report, Celent presents market insights to explore the implications of next generation technologies on XVA management practices, vendor offerings, emerging themes and the future trajectories.