Financial markets and the broader economic landscape are undergoing substantial turmoil. Swings in market activity, upward interest rates, and the resurgence of regulatory intensity are already evident, with many in the industry expecting significant market volatility, recessionary headwinds, and technology-led disruptions ahead.

Market, counterparty credit, and XVA risks, although perceived as mature and well-controlled risks, are not immune to ongoing developments in the market. For capital markets organizations, navigating complex and volatile markets will require a fit-for-purpose, nimble posture underpinned by next-generation trading and market risk technology capabilities.

However, risk functions (and risk management technology) have not always been at the forefront of digital change. Indeed, one could argue that, more often than not, they have lagged behind other parts of the financial services business in their ambition and appetite for change in a digital world. Recent global pandemic and sociopolitical events, alongside the rapid acceleration toward digital paradigms, are bringing the future coming back into focus.

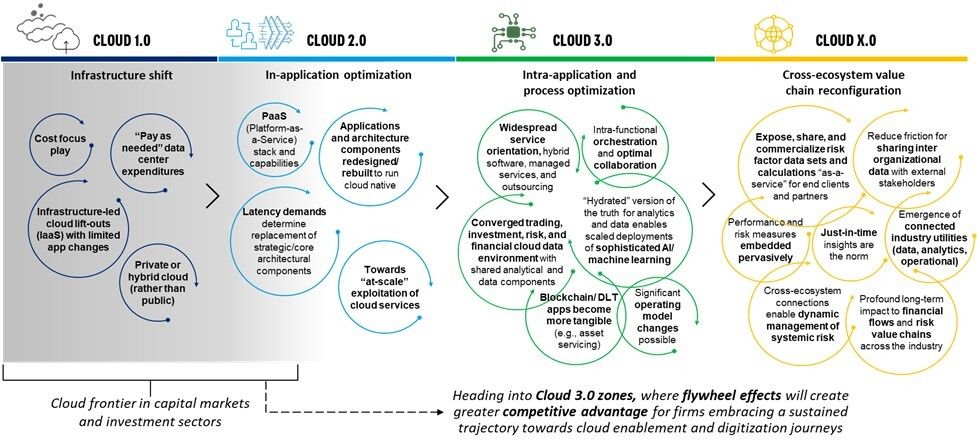

Firms currently at nascent stages in the evolutionary curve for their risk ecosystems should take heed. As the industry heads into Cloud 3.0, we expect capability gaps between trailblazers, followers, and laggards to widen due to fast movers reaching sustained innovation momentum, fortification of skillsets/talent base, and networked ecosystem-led leverage from new cloud-enabled propositions.

Forward-looking firms are driving offensive and defensive efforts to streamline core business/IT and front- to middle-office risk management processes in order to achieve timely, data-driven, and risk-aligned decisions. Making smart investments now means not paying the price later. The old maxim is still true: Fortune favors those who prepare. Whichever route firms take, the end game for winners will be to empower themselves to move faster, stay leaner, and get ahead.