Big changes are coming to the US payments industry. These changes, and how banks respond to them, will be competitive differentiators for the bank that gets it right.

Stories discuss the move away from cash and check to electronic payments, and the growth in payments overall. In prosperous times, people and businesses spend more, and make more transactions; in less prosperous times, they make lower value transactions, often spread out over more payments.

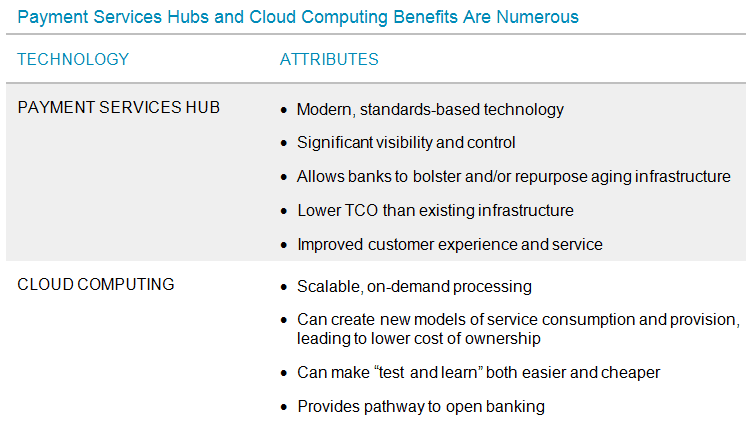

However, upcoming changes coming to the US market are forcing many banks to rethink their strategies and infrastructures as they seek to compete — and stay competitive. As payments accelerate and standardize, banks need to consider a wider variety of approaches when looking to update or replace infrastructure that is not up to the challenge of current and projected market conditions.