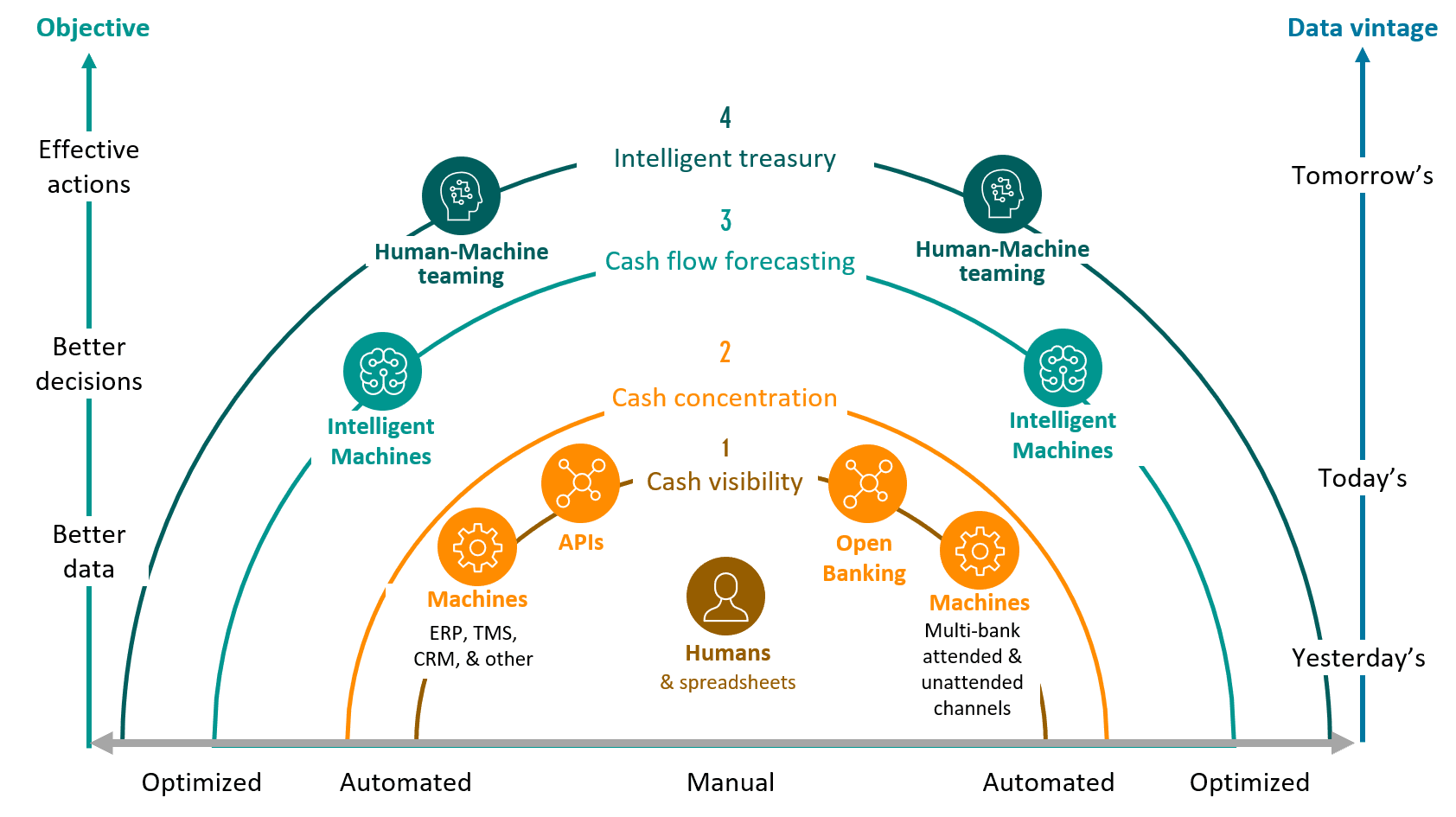

Breakthrough innovations are occurring in cash management thanks to advances in artificial intelligence and machine learning (AI/ML), connectivity, and tech infrastructure modernization. Innovation is occurring not only in the tech realm but also in bankers’ strategic approach. Pacesetter banks are rethinking their value propositions, moving away from products/services toward adding client value in the form of operational efficiency and smarter decisions. They are striving ultimately to deliver intelligent treasury.

The economic repercussions of the pandemic have underscored the importance of cash management, including cash visibility, cash flow forecasts, and actions based on the forecasts. Many corporations have experienced a harsh spotlight on the shortcomings of their cash management and overall working capital management. Surveys show that they have been taking action in 2021 and are striving to realize further improvements in 2022. Pacesetter banks have been responding by developing solutions that eliminate the shortcomings. Several are positioning cash flow forecasting as an anchor service that will expand their advisory role and, ultimately, their share of wallet.

Figure 1: Waves Toward Intelligent Treasury

The quest for intelligent treasury is progressing. Celent profiles three banks that are pacesetters in launching advanced cash flow forecasting, either through partnerships (Bank of America) or by building a proprietary solution (J.P. Morgan and PNC). For banks that are interested in evaluating partnerships, we examine three point solution providers that are at the cutting edge of innovation: Cashforce, Tesorio, and Trovata. In addition, we provide a preview of NTT DATA’s cash flow forecasting solution to be launched in 2022, which it is developing specifically for banks to offer to their clients.

Delivering intelligent treasury is the long game and will lead to sustainable competitive differentiation. Banks that position cash flow forecasting as a gateway service, that is, one that leads to the use of additional services, will take the competitive lead. Armed with a strong understanding of a client’s current and future cash flows, they can better serve that client through advisory services and prescriptive tools. They can better enable a client to take the best action at the best time, deliver the right product at the right time, and/or adjust a product to optimize its use. Because they are leveraging ML models, which continually get smarter, they could establish a lead that is increasingly hard to close.