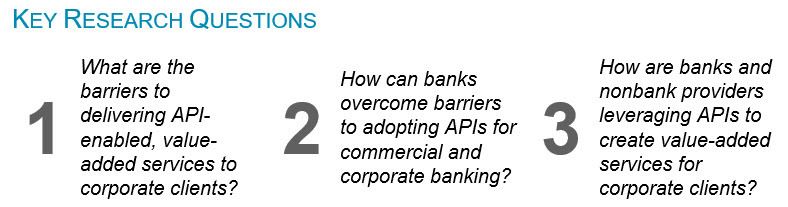

Many banks lament corporate treasurers’ lukewarm demand for real time payments, causing those financial institutions to postpone investments in business-focused APIs due to the lack of a clear business case for investment. But real time payments are just one of the many use cases for new and innovative, value-added services enabled by APIs. While both banks and corporate treasurers recognize how APIs can overcome digital challenges and enable value-added service, barriers to adoption remain.

Celent's extensive analysis of open banking developer portals around the world show that few banks have exposed APIs for commercial products and services, including access to company profiles, current account balances and transactions, and business services such as wire transfers and foreign exchange contracts. Beyond a lack of a clear business case for investing in APIs, banks are hampered by the limitations of their legacy technology infrastructure, insufficient knowledge of APIs, and perceived risks with the technology.

Celent outlines key steps to overcoming barriers to adopting APIs for commercial and corporate banking: enabling real time connectivity, learning more about APIs, creating a compelling business case, and managing risks associated with APIs and open banking. Lastly, we profile banks and nonbank providers alike that are leveraging real time APIs to drive business results with value-added services using APIs for integration, Banking as a Service (BaaS), banking innovation, and client connectivity.