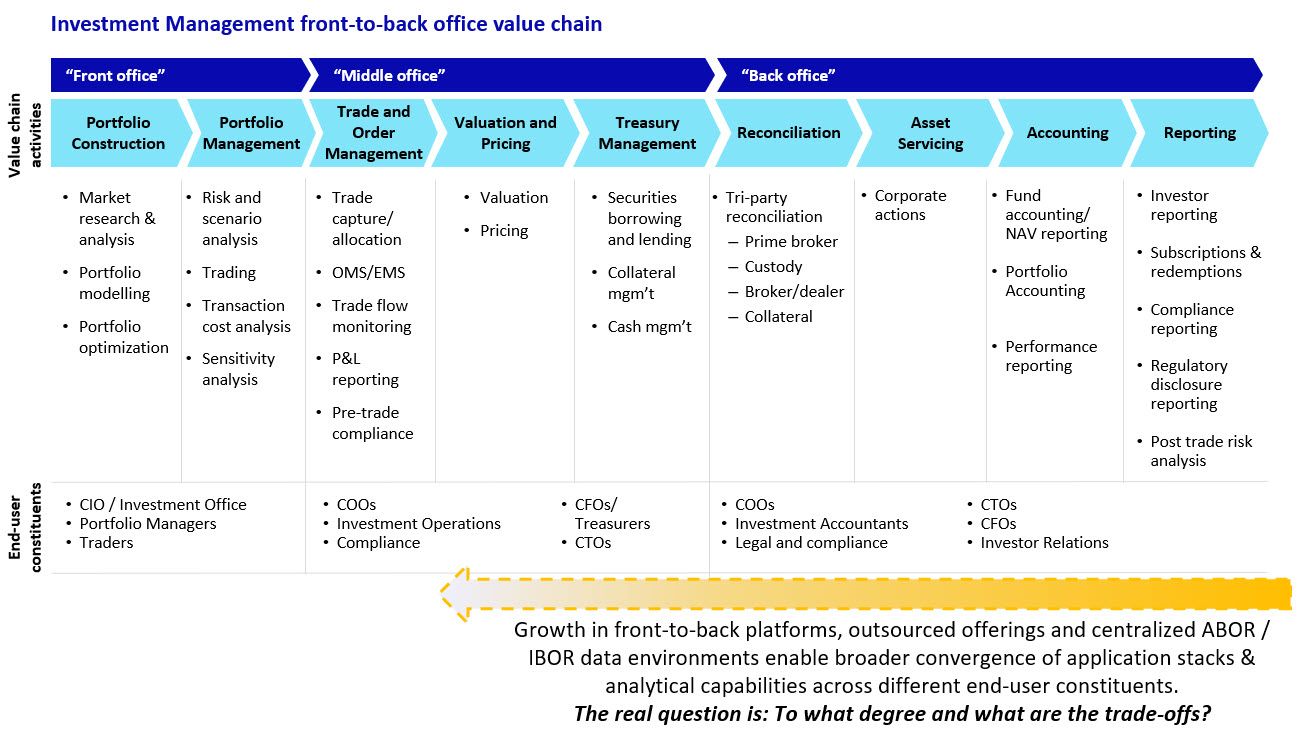

Celent research shows that pandemic effects are acting as a catalyst to change imperatives across the investment operations value chain. Specifically, we see growth in front-to-back platforms, outsourced offerings and centralized ABOR/IBOR that that enable a broader convergence of application stacks & analytical capabilities across different end-user constituents -- moving from back-to-middle (to front) office.

More than not, the dynamic around the convergence of the investment value chain continues with growing momentum. The real questions, from an investment manager, and also from a regulatory supervision standpoint are:

How widespread will this convergence become? And what are the trade-offs?

Here, I will offer up some perspectives:

- Digital investment ecosystems look to become a growing paradigm. We envisage the future to look more like conglomerates of open, connected digital "investment ecosystems". In the next decade, we expect end-to-end investment technology solution suites to dominate and evolve into more open, “industry operating infrastructures,” with a network of specialist providers developing/enhancing different parts of the value chain, to which these technology platforms support.

- Hub and spoke innovation models. We anticipate that end-to-end solution suites will increasingly become a hub into a more prolific ecosystem of services. Specialist requirements will still exist, but best-of-breed solution or component providers would need to expand their functional or asset class coverage through internal development, or form alliances with adjacent peers across the value chain to form ecosystem clusters. In order to fill in functional gaps and plug in their components into the broader ecosystem, firms must be able to demonstrate stronger interoperability, value-added specialisms, and economies of scale in that specialism. The need for better process/workflow orchestration will be more pronounced.

- Open, modular coopetition. In line with emerging technology trends toward modularization, we expect some end-to-end platforms further decompose themselves and “open up” (to various degrees) into functional components, modules and increasing through managed services. In certain cases, there will be heightened competition between specialist providers and the components of these end-to-end platforms.

- Strategic and operational trade-offs required. In the near to mid-term, not all vendors and solution providers will necessarily be able to deliver full coverage or realize the end vision envisaged here. Investment managers will need to consider strategic and operational trade offs around what activities need "best of breed" vs "sufficiently adequate" capabilities.

- Systemically significant entities and higher concentration of risks. By nature, these end-to-end industry operating infrastructures are systemically important, for instance, in terms of the potential systemic failures, operations risks, and potentially, the homogeneity of models that support investment decisions. This would be concentrated in the hands of fewer players, and the continued transition of IT infrastructures into the cloud could further reinforce this.

- Greater regulatory scrutiny. With the COVID pandemic as its impetus, Celent anticipates that the regulatory community (such as the Fed, Bank of International Settlements) will increasingly focus on operational resilience, especially as these ecosystems grow into systemically-important "network of entities".

- The end goal needs to be operational efficiency and resilience but also stronger information supply chains. The convergence themes that we are seeing are as much about data (and the integrity of the investment information supply chain) as it is about operational efficiencies. The two are intertwined. Within this envisaged “open architecture” or “open data interchange” landscape, there are opportunities for the buy side, service providers and FinTechs to form ecosystem clusters to improve efforts around the “assembly of solutions,” especially across different asset class apps, pricing, risk analytics, and data channels — for instance, to drive next-generation initiatives around the electronification and connectivity in secondary fixed income markets (data, analytics, and operations); or even for primary markets for issuance, distribution, and administration through technologies like DLT/blockchain.

Celent believes that the investment industry is at an inflection point. The combination of persistent margin pressures, uncertain business conditions, and slowing revenues are leading many investment firms to rethink or reshape how they go to market operationally. And these changes are no longer “nice to haves”: There now offer real opportunities to employ digital technologies that improve operational performance and reduce costs.

In the years ahead, we expect 3-5 players to emerge to be the 'movers and shakers' that will shape the 'operational backbone' of the investment industry. The race has already started and can only get more intense.

---------

To learn more about how investment management firms are upgrading their operations, please contact Celent for more information on our latest reports on these topics (subscribers can link through to the full reports):

End-to-end solutions set to revolutionize investment technology

NextGen Investment and Accounting Operations: Envisaging Future Solutions and the Case for Change

SS&C Singularity: Moving into The Future of Investment Accounting Operations (Celent Briefing Note)

NextGen Invest and Risk Tech: Gazing Through A Crystal Ball Into 2030

Embracing NextGen Invest and Risk Tech (Asset Manager Edition)