複数の規制、税制、会計制度(戦略、ファンドタイプ、投資家セグメント、資産クラスによって微妙に異なる)にまたがる新たな要件は、継続的に投資データの検証と調整を行うためのデータ収集と集計作業の負担を増大させている。

保険会社や投資運用会社は、ソルベンシー/ 資本要件、税金の制約、異なる税法規、会計ルールの下での実現損益に留意しつつ、ポートフォリオを最適化するための意思決定を行うことを目指している。ビジネスの野心や厳しい市場環境の中で、企業は成長を支え、収益性を維持するために、投資会計などのミドルオフィスやバックオフィス業務に関連した効率性向上やコスト改善の方法を模索し続けている。しかし、時代遅れのテクノロジーやレガシーな業務のために、投資/ 会計業務は、新商品の開発や地域拡大に向けた取り組みにおいて、敏捷性、市場投入スピード、変化への柔軟性を妨げる障壁となる可能性がある。

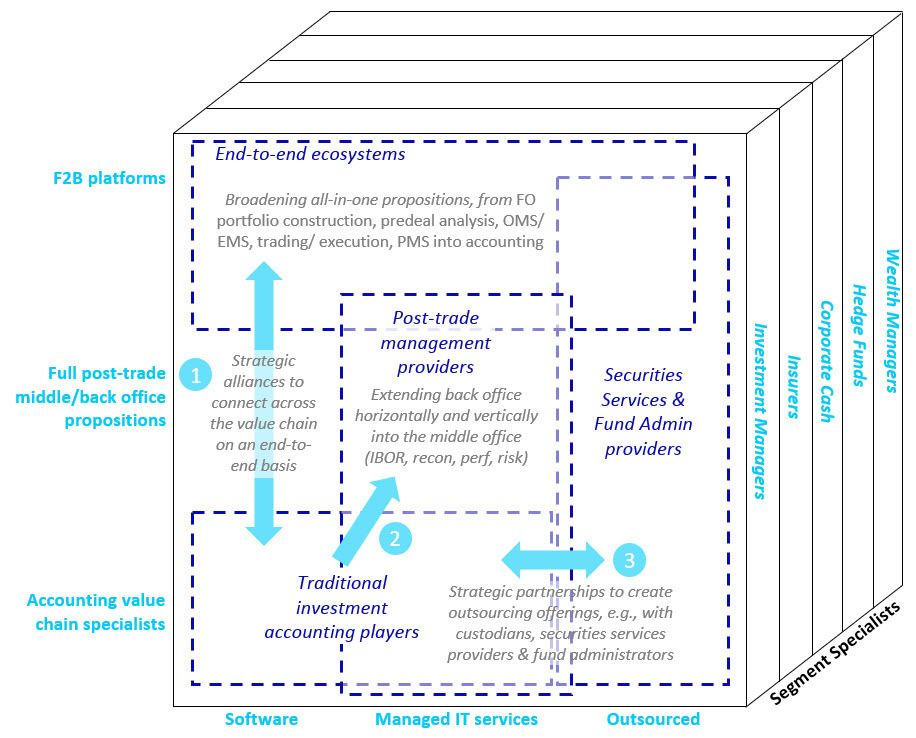

近年、次世代のテクノロジーソリューションやバイサイド向けの「大規模な」ソーシングオプションが拡大し、マネージドサービス、ホステッドソリューション、アウトソーシングが主流となっている。エンドユーザーの需要が戦略的なベンダーとの関係を希薄にする方向にシフトしていることから、ベンダーは、バリューチェーンの他のプロバイダーとより広範につながり、他のプロバイダーと連携して自社の製品をその他の製品(難解な資産価格モデル、従来のデータセットと代替データセット、ニュース/センチメント、AIを活用したアナリティクスなど)とプレパッケージまたはプレバンドルするためにパートナーシップを形成まはた拡大することを余儀なくされている。そのような状況において、モジュール化は製品/ サービスのアンバンドル/ 再バンドルを可能とし、相互運用性(マイクロサービスやオープンAPIなど)はモジュール化された製品を採用して新しい提案やイノベーションを生み出すことで、協調的なパートナーシップを促進するのに役立つ。

今後数年のうちに、投資会社は最新の投資/ 会計/ ポートフォリオ・ソリューションにより、コラボレーティブなワークフローとダイナミックなエンドユーザー/ ペルソナベースのカスタマイズに支えられながら、より低い総所有コスト(TCO)で、ポートフォリオ全体の整合性、リアルタイムの透明性、分析力の強化を実現できるようになるとセレントは予想している。

投資会計はディスラプションの機が熟した代表的な分野であり、本レポートでは、次世代ソリューションの将来的な特徴と、保険会社、投資運用会社、ウェルスマネジメント会社にとっての変革の可能性を検証している。また、この分野のランドスケープやフロンティアを変革しているベンダーやソリューションプロバイダーについてのインサイトも提供している。

(詳しい情報は、セレント北川俊来TKitagawa@celent.comまでお問合せください)