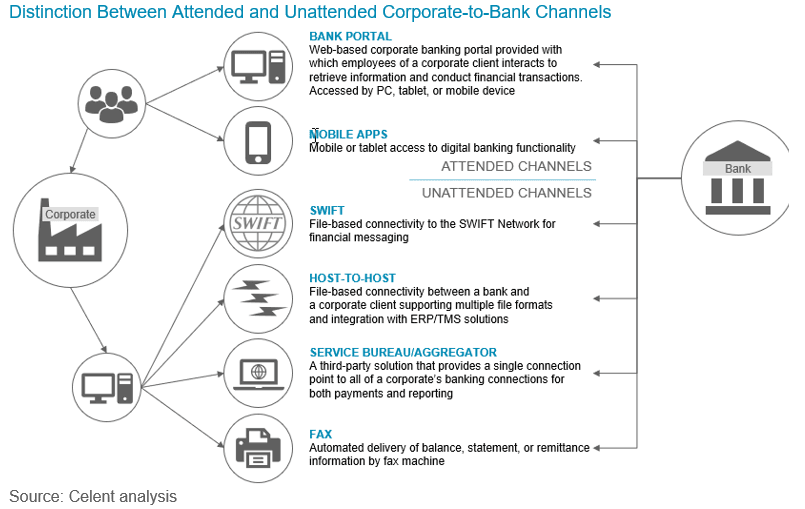

益々ハイブリッドになっている企業/銀行間のコネクティビティーに対応するために、銀行は企業の個別業務プロセスに合わせた様々な有人/無人のデジタルチャネルを提供しなければならない。企業デジタルポータルが注目を集めているが、より多くの顧客を引き付けようとする銀行は、無人チャネル に注目すべきである。

に注目すべきである。

多国籍で大規模な法人顧客は、ホスト間のファイル統合およびSWIFTネットワーク接続を期待している。しかし多くの銀行は、統合のし易さ、ファイル・フォーマットの問題、テスト手順、セキュリティのプロトコル/手続きのような、実施上の課題に取り組んでいる。多くのメッセージ交換規格の普及は、ファイル変換を企業/銀行間インテグレーションの重要な要素とし、企業のTMSおよびERPシステムへのストレート・スルー・プロセッシングを可能としている。