Asset managers must deal with incumbent front-to-back architecture and stay extremely competitive.

A number of asset management firms fund administrators have a core portfolio management / portfolio accounting systems that contain legacy code and are way too complex to rip and replace. In order to meet increasing investment demands, a layering replacement approach is being used to take advantage of fintech, open APIs, and cloud offerings for cost-efficiency.

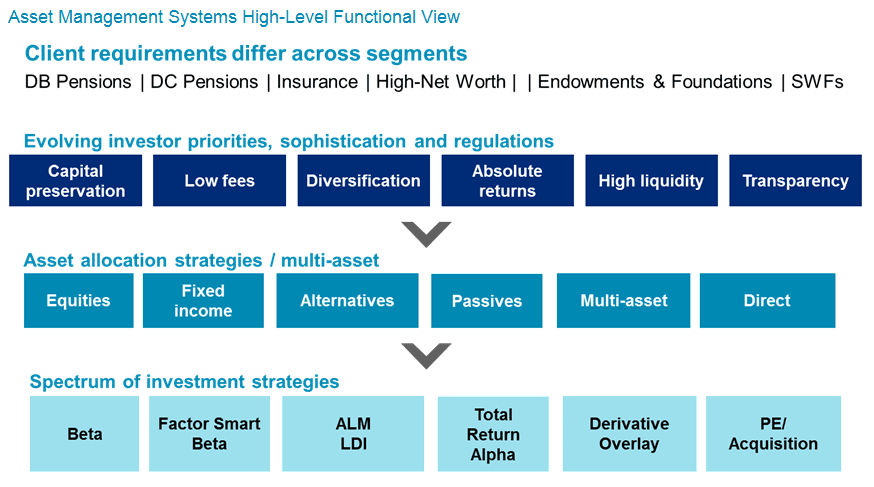

Since the financial crisis, institutional asset managers have been diversifying their portfolios to better achieve investment mandates. However, many asset managers are finding their existing operations and technology are not up to the task. Executing and maintaining new diversified portfolio allocations involve using manual patches that are operationally risky and cost-prohibitive. A complete reengineering is only a solution for a few. Yes, asset management technical architecture should target the investment book of record (IBOR), but the majority of AMs already have years of commitment to existing systems and need to work with incremental solutions that reduce operational costs but not at extreme capital outlays.