Parsing the Data Aggregation Landscape in the US

From Antagonist to Ally

Abstract

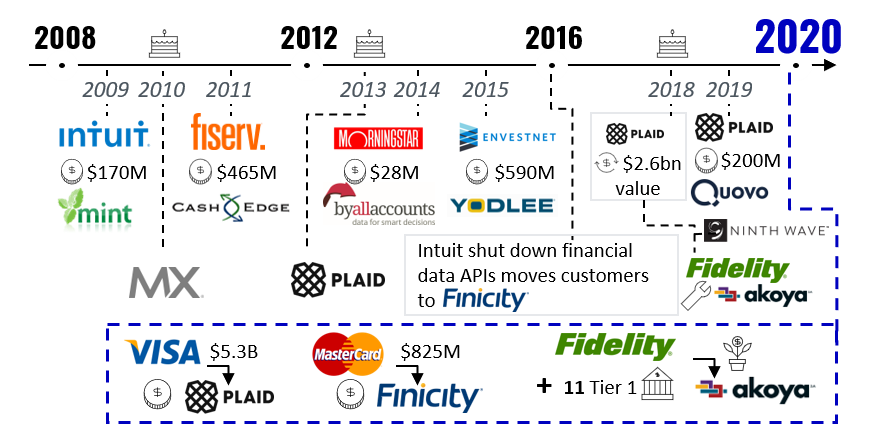

Aggregation is no longer about simply connecting financial institutions to data. It has grown to include a much more comprehensive set of capabilities around open banking, data services, ecosystem management, and curated use cases. Against the backdrop of open banking and the increased importance of connectivity in financial services, data aggregation has emerged as a hot topic for institutions now viewing these providers as collaborators rather than antagonists. As shown in the figure below, the last few years have brought a flurry of activity as valuations continue to soar and splashy acquisitions make headlines.

Aggregators continue to amplify their value by building more robust platform capabilities on top of connectivity to data. Leaders are emerging with better platform management capabilities, wider access to data types, proprietary offerings, or data curation for specific use cases.

A sample of trends included in this report:

- Leading platforms are moving beyond data: Data aggregation is becoming a commodity. Those attracting lofty valuations and increased interest are moving beyond connectivity and towards value-added services. This includes everything from differentiated data enrichment/enhancement to curated offerings for financial institution functions such as consumer credit decisioning or scoring.

- Connectivity networks are the future: The future with be platforms which broker "one-to-many" connections to permissioned customer data. Like the value of a card network, these platforms act as a gatekeeper and enforce strong authentication, encryption, and SLA requirements. Third parties integrate to the platform and have API access to data sources on the other side. This will hasten broad connectivity in the US by reducing the effort to reach bespoke partner aggreements.

- Competitive dynamics in the market favor co-opetition: Aggregation providers are not usually competing head-to-head, and capabilities work well with, and often sit next to, other competitors. This has traditionally been a product of specialization and different GTM strategies reflecting distinct buyers or verticals. Likely co-opetition will start to fade way as many of these platforms seek to scale and broaden supported data types, platform capabilities, and partnerships.

For more trends and details on the provider landscape, please download a copy of the report below.

Vendors mentioned in this report:

Akoya, Ninth Wave, MX, Fiserv, Finicity, Plaid, Envestnet Yodlee

Financial Institutions mentioned in this report:

Wells Fargo, Citibank, JPMC, Capital One