北米の生命保険会社は、少しずつではあるが、新規契約や引受プロセスの自動化を進めている。再保険ルール・エンジンを導入して申込書の引受判断を自動化したり、ケース管理ツールや保険業者ダッシュボード、ベンダーが提供する引受ルール・エンジンで構築した独自のルールを利用している。しかし、これらのシステムの現在の状況はどのようなものだろう?

セレントは、昨年の新規契約/ 引受システム・ベンダーの調査で得られた顧客フィードバックを分析し、過去2回のベンダーレポートの顧客フィードバックと比較している。データを分析した結果、議論に値するいくつかの傾向が指摘されている。生命保険会社は新規契約プロセスにおける自動化の必要性を感じており、ベンダーはこのフィードバックを認識し、保険会社のニーズに確実に応えていく必要がある。

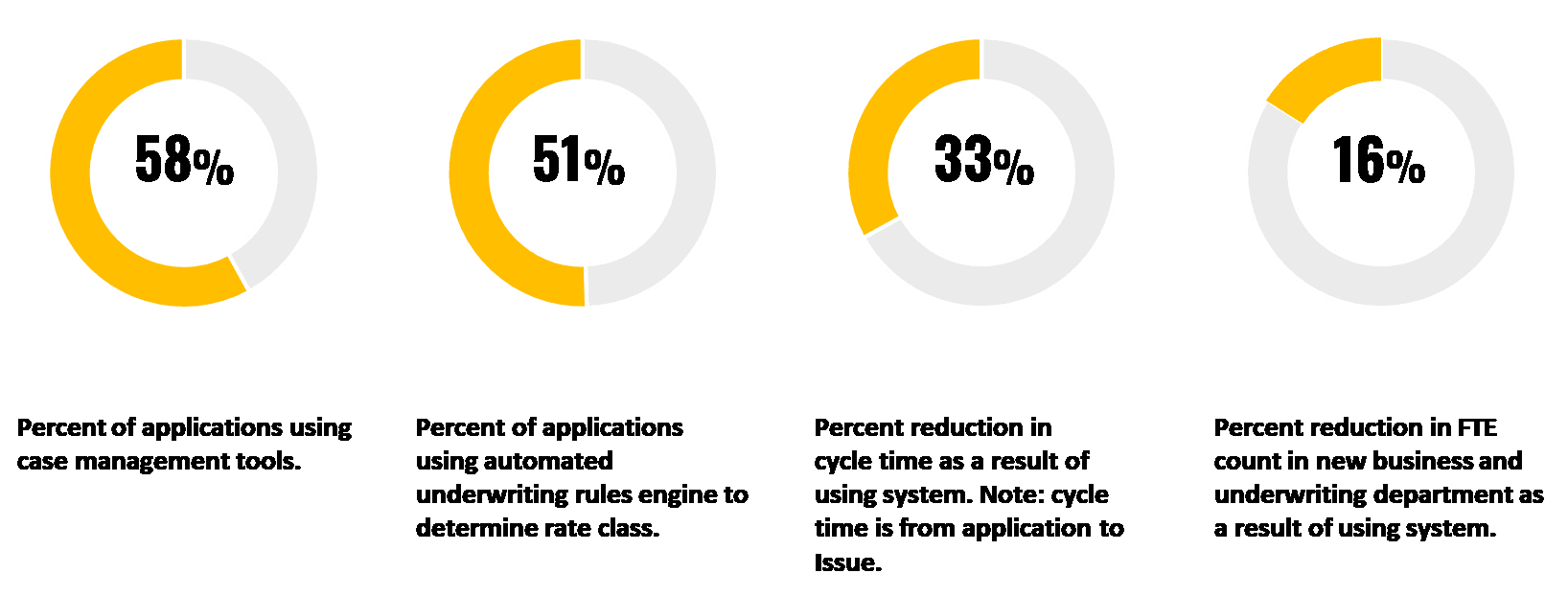

新規契約/ 引受システムの使用状況と成果に関する主要指標