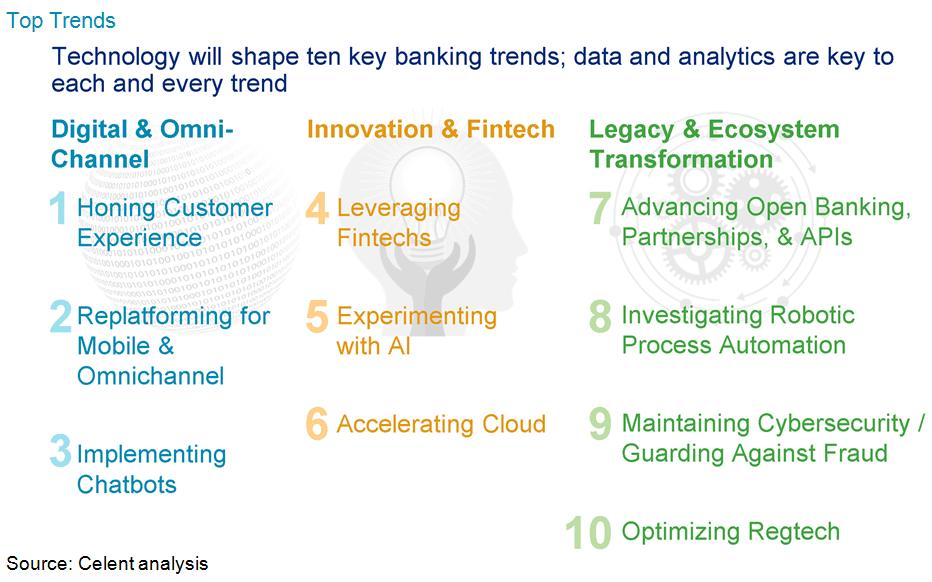

Celent’s current edition of top trends in retail banking explores the issues that executives at banks and credit unions of all sizes should be aware of. Some are cutting edge, while others have been persistent over time. Who knew a year ago that AI would garner so much attention? That chatbots would make so much progress? Or that open banking would be a thing?

It's been a tumultuous year in banking, with new technologies and techniques rapidly gaining traction. What areas should bank technologists focus on in 2018?

Our analysis is high-level and aims to provide a quick perspective and the most salient technologies affecting banking in 2018. Our insights are built off research we’ve conducted, conversations with banks and credit unions, and demonstrations and interviews with vendors. Deeper dives can be found in companion reports; here we’ll answer three burning questions.