In today’s hypercompetitive and rapidly changing landscape, improving customer experience has become a strategic imperative. For many insurers, increasing automation of their claims process is an impactful way to enhance the customer journey while also delivering more concrete benefits of reduced costs, improved efficiencies, and better outcomes. Claims automation in many cases, especially low-touch-high frequency situations, can yield tangible benefits for both the policyholder and the carrier.

Celent’s report, Unlocking The Value of Touchless Claims, helps insurers better understand how to embark on a successful claims automation journey. Topics covered include:

- Introduction to touchless claims

- Benefits broken down by insurer and policyholder

- Candidates for claims automation by line of business

- Applicability throughout each step of the claims process

- Ingredients for a successful journey

Unlocking The Value of Touchless provides recommendations for insurers, including:

- Consider how touchless claims will help your organization fulfill its broader strategic objectives

- Understand that ‘going touchless’ is a process. Insurers typically don't start at zero touchless and instantly go to 100% touchless

- Define the pain points within your claims process and determine where to begin the claims automation journey

- Don’t feel it is necessary to go it at alone

- Think about ways to leverage both structured and unstructured data to expedite the claims process and make better decisions

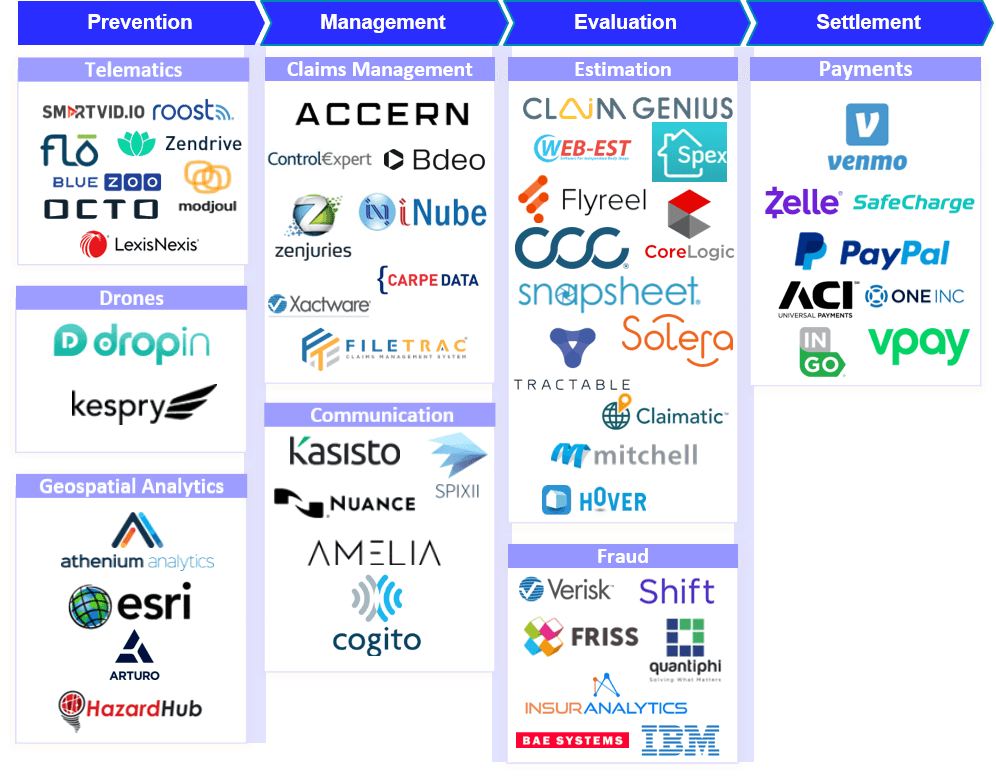

Claims InsurTech Ecosystem

Unlocking The Value of Touchless contains some of today's most innovative InsurTechs that are helping to successfully automate their claims processes. With advances in AI/ML, telematics, image quality, data capture, and direct payment, insurers have derived more value from touchless claims. Additionally, there are several examples of leading insurers who have leveraged technology to achieve their desired objectives.