トランザクションバンキングでは、2020年に金利が大幅に低下したことで純金利収入が壊滅的に落ち込み、それまでの3年間の伸びが実質的に帳消しになった。2021年にはトレードファイナンスの収益は小幅に増加したものの、キャッシュマネジメントの収益が減少し、困難な状況が続いた。こうした収益の減少にもかかわらず、トランザクションバンキングは安定した収益、顧客との強固な関係性、低い自己資本要件、銀行にとっての資金調達源という強みを持つことから、依然として非常に魅力的な分野であるといえる。

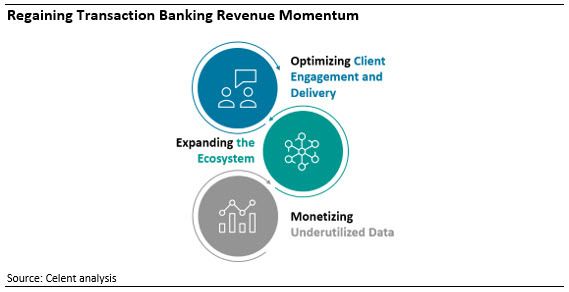

トランザクションバンキングの収益力を取り戻したいと考えている銀行にとって、テクノロジーは好機になると同時に課題ももたらすとセレントは考えている。そこで、伝統的で垂直統合された銀行の商品販売モデルと、破壊的でアジャイルなプラグアンドプレイ型のフィンテックプレーヤーを踏まえ、銀行がトランザクションバンキングの収益力を取り戻すための3つのテクノロジーを基盤とした戦略について概説する。

今こそ、銀行はトランザクションバンキングにおけるテクノロジー導入競争に対応すべきときである。2021年7月にFinancial Timesが報じたところによると、フィンテックの競合相手からの脅威が高まったこともあり、米国の大手銀行はテクノロジー、マーケティングおよび人材への投資を拡大させているという。

この競争で確実に成功を収めるためには、銀行は自社の野心的な目標と顧客基盤に合わせてトランザクションバンキングのテクノロジー戦略を慎重に構築する必要がある。もちろん、「me too (私も)」という姿勢で臨むべきではない。競合相手の投資行動をコピーさえしていれば、競争力を維持していると感じられるかもしれないが、顧客のウォレットシェアを取り戻す上で優位に立ちたいのであれば、差別化は不可欠である。