Stripe just announced that it will launch Stripe Treasury, a banking-as-a-service offering for its e-commerce platform customers (e.g., Shopify), which allows them to offer their merchants an interest-bearing deposit account along with flexible payment services. Stripe’s move is much more than an adjacency play. Rather it is a beacon of the reinvention of small business banking and signals that the next five years will see a heated battle between the platform giants and aspiring bank innovators. The winners will be those that pursue an embedded banking approach which pulls in products/services and data analytics into the workflows of small businesses.

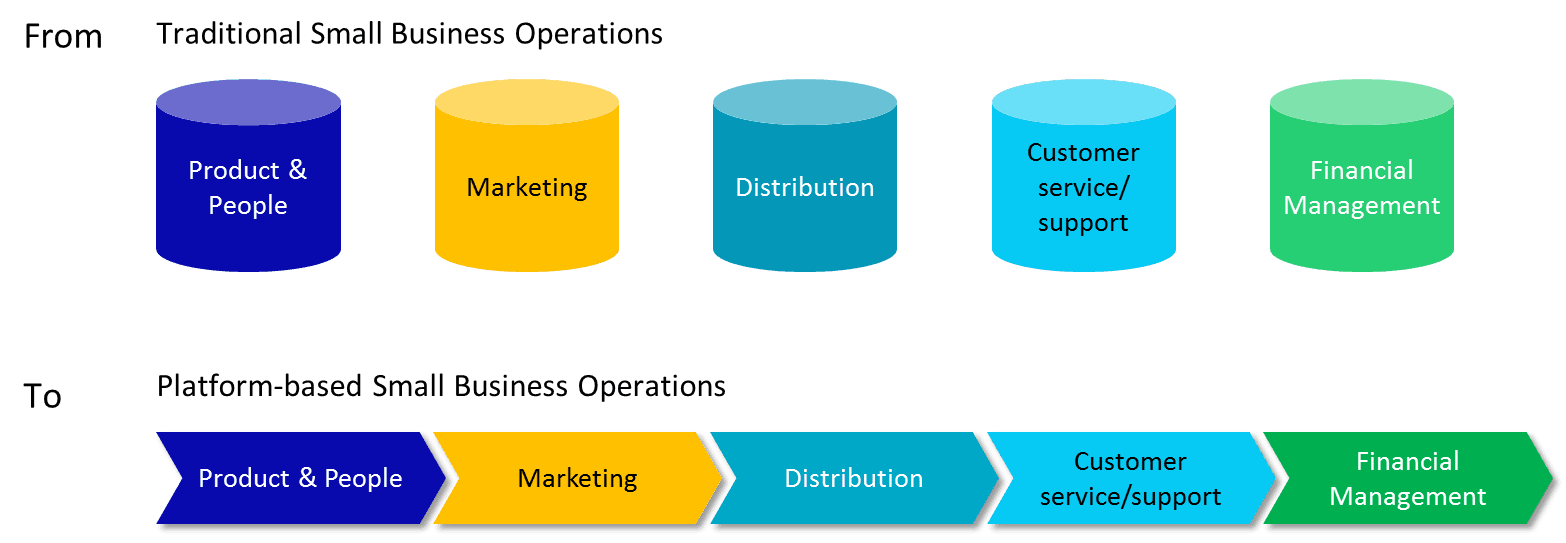

Stripe, along with other platform players like Square, Amazon, Shopify, and Intuit, have already reinvented the small business operating model, migrating it from silos to a linked workflow.

Figure 1: From Silos to Chevrons

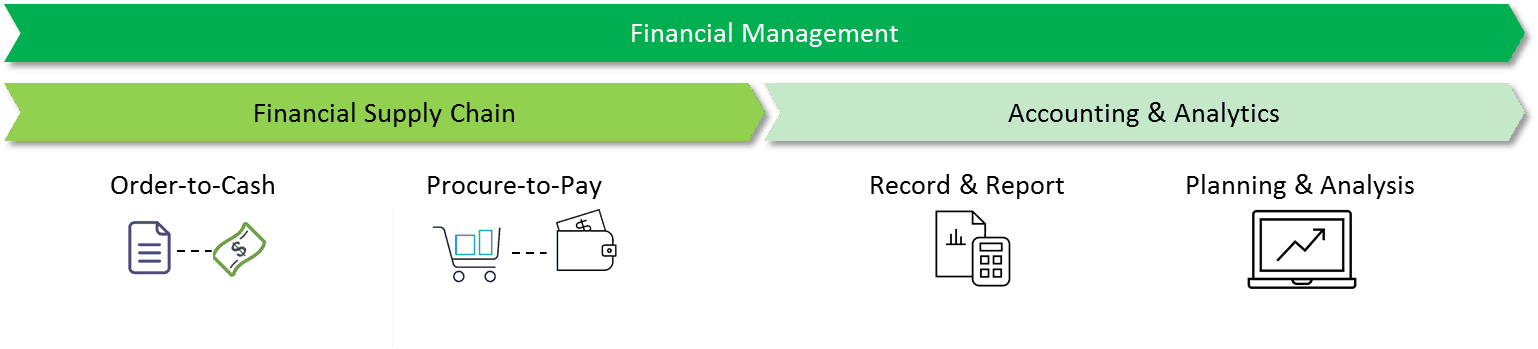

By reinventing small business operations, these platform players are reinventing small business banking. It needs reinvention because small businesses view banking as well as financial management overall dramatically different from banks’ view. Small businesses think about workflows and banks think about products with most still offering “checking accounts.”

Figure 2: Small Businesses Think about Workflows

Figure 3: Banks Think about Products

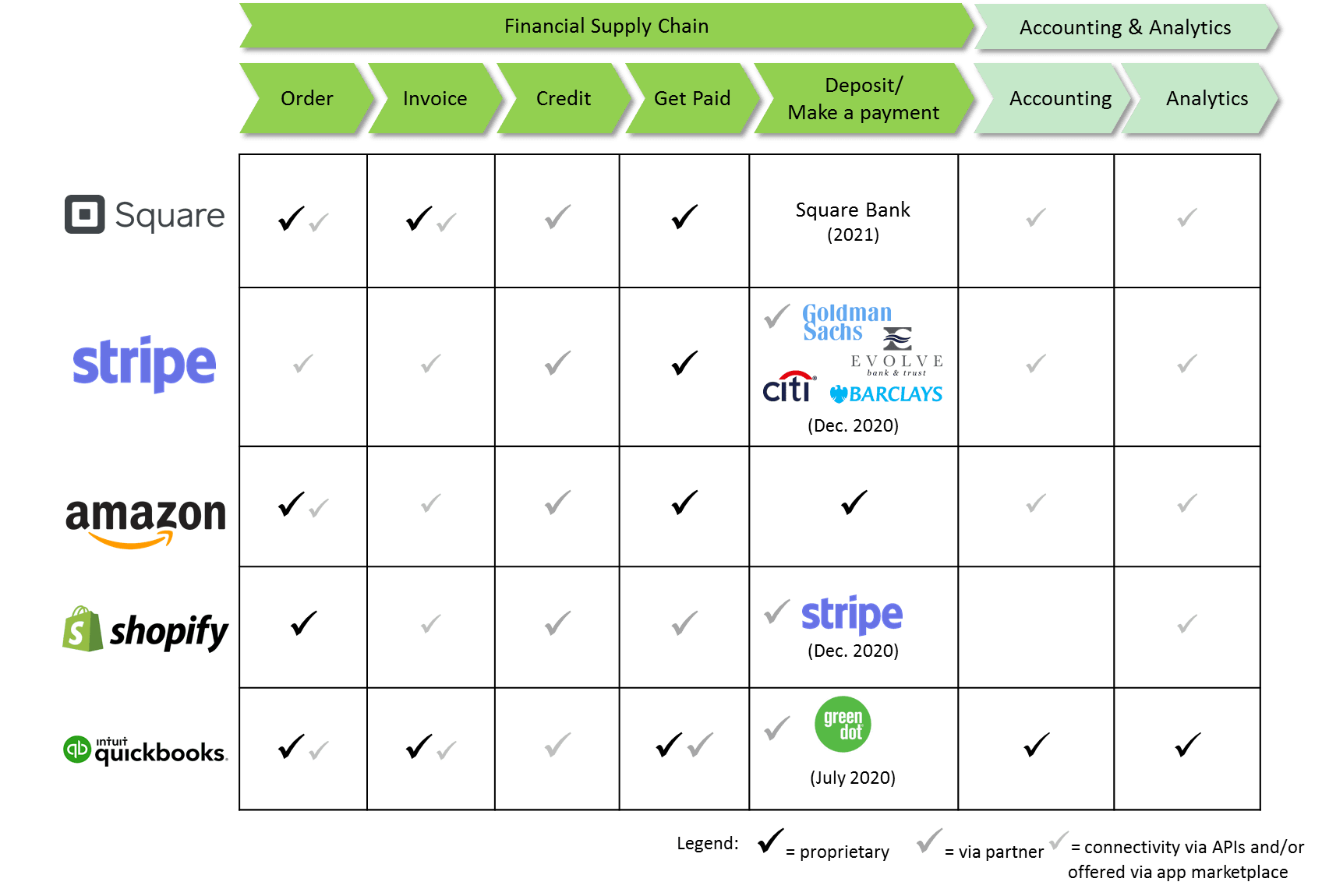

Reinvention translates into supporting each chevron in the financial workflows of small businesses and embedding banking services. With the addition of a deposit account these platform players are nearing the finishing line.

Figure 4: Platform Players Supporting Workflows and Embedding Banking

It’s not a forgone conclusion that banks won’t be among the reinvention winners, however. In Reinventing Small Business Banking Part 1: Pacesetters in Embedded Finance, a Celent report to be published the third week of December, I will discuss these trends and how banks can respond by teaming with fintechs that are enabling banks to reinvent and deliver a workflow approach along with powerful data analytics.