In a marked shift from Celent’s three previous biennial surveys, improving sales results is no longer job number one. Surveyed North American financial institutions now solidly identify improving customer relationships as their top retail banking strategic priority.

Celent has released a new report titled A Survey of Retail Banking Channel Systems in North America: Omnichannel Emerges. The report was written by Bob Meara, a Senior Analyst with Celent’s Banking practice.

Improving customer relationships is now job number one. In a marked shift from Celent’s three previous biennial surveys, improving sales results is no longer the priority. After surveying 112 top North American financial institutions, the results solidly identify improving customer relationships as their top retail banking strategic priority.

Spending priorities since 2010 have steadily shifted from physical to digital channels. Mobile is now broadly the highest channel priority among the majority of institutions. Moreover, improving platform capabilities is the most important technology initiative supporting banks’ strategic priorities.

No longer just a self-service delivery channel, digital is becoming a primary engagement mechanism for both self-service and assisted / full-service interactions. As this sinks in, institutions will invest in channel platform consolidation, beginning with the digital channel, already underway.

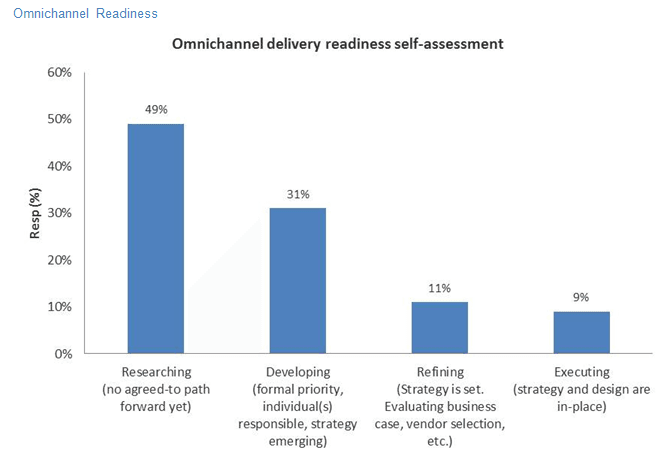

While conceding the importance of omnichannel delivery to deliver key strategic priorities (4.1 on a 5.0 importance scale), fully half of surveyed institutions have not begun substantive efforts. Roughly half of institutions have a person or team charged with its realization. Just one in ten surveyed institutions are executing a strategy.

“Mobile banking platform competitiveness is now most every institution’s top technology priority — and rightly so. This is evident in the pace of new mobile banking capabilities being introduced,” commented Meara.

“But, most every institution’s number two technology priority, omnichannel delivery, has not yet been met with the activity it merits. Fully half of surveyed institutions don’t have an individual or group tasked with omnichannel delivery and have no strategy yet in place to bring it about,” he added.