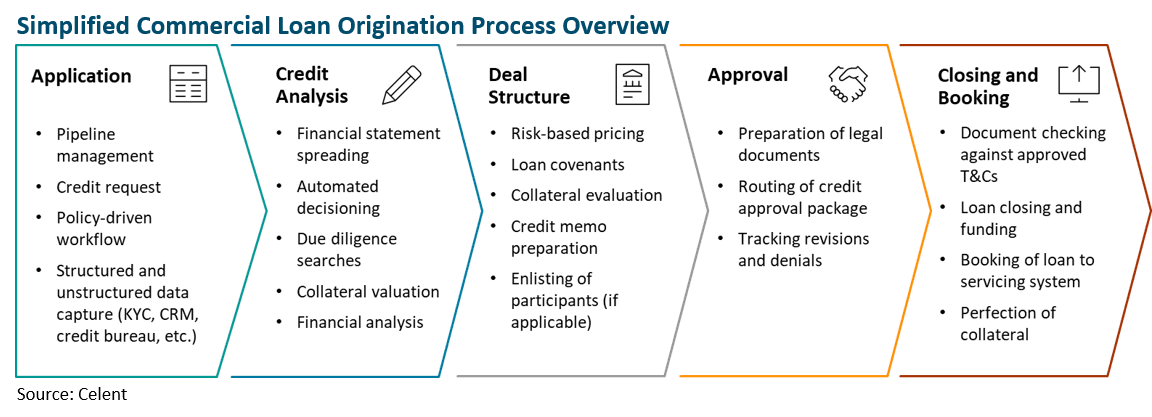

The commercial loan origination and underwriting process still looks the same as it did 20 years ago. It starts with developing leads and fleshing out a credit request, moving onto credit and financial analysis, through to deal structuring, preparing and revising approval documents, and finally ending with loan closing and booking to the loan servicing system.

Thanks to advances in technology, a greater volume and range of data can now provide more insight than ever on corporate borrowers. But which data sources should you mine? And how do you choose the right tools for the job? Data-driven trends can revolutionize commercial loan origination, accelerating time-to-yes and time-to-cash.

Data, analytics, and enabling technologies are integral to successful transformation projects and are critical components to helping banks maximize re-platforming benefits and business outcomes. But banks don’t have to wait for a massive modernization program to take advantage of data-driven strategies and tactics to help move up the analytics maturity ladder. The ultimate goal is a seamless set of technology, workflows, and processes to manage clients and their loans from cradle to grave—built upon strategic systems with clean, comprehensive data sources. For most banks, there is still much work to do.