B2B technology platforms allow wealth managers to jumpstart their digital advice capabilities and empower their time-starved advisors.

Next-generation technology platforms are stepping up to fill the technology gap left by TAMPs and other legacy vendors. Who are these new providers of investment services, and how can they supercharge the efforts of banks?

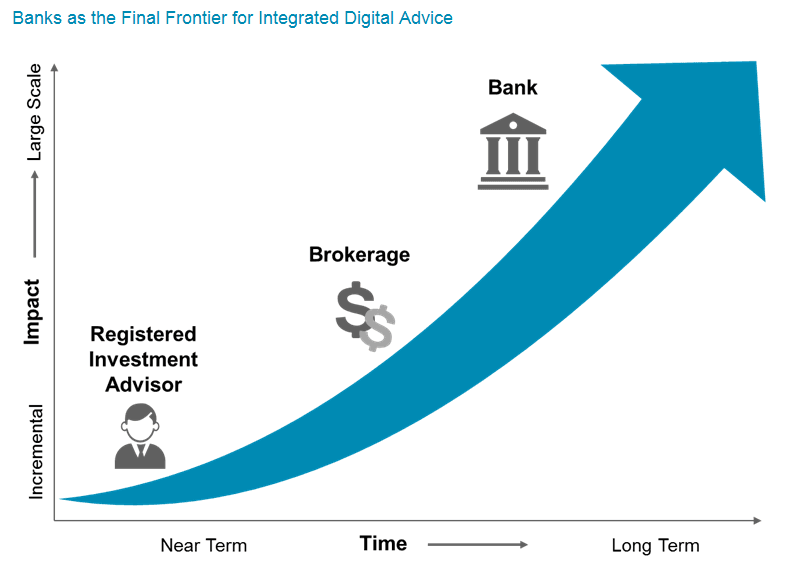

This report explores the extent to which digital and human-led are converging in the bank business. It proceeds to assess the extent to which various forms of hybrid delivery can break tradeoffs between personalized service and scale. Lastly, it explores the value propositions of three pioneering B2B digital platforms and highlights the differences in approach that color their applicability to banks and other financial institutions.