The nature of data available to insurers is changing. Leading insurers are increasingly looking outside the traditional transactional data sets as the data ecosystem expands. These new data value chains connect traditional policy data with behavioral and relational data and socio-economic data. As data capabilities mature, leading insurers are extending the value chain to completely new data sources, types, and providers.

Developing and implementing a comprehensive LOB data strategy is challenging. If data is the fabric of insurance, that same data asset is used for operational execution, regulatory reporting, insights, and the creation of new solutions. This asset must be controlled and structured, yet also accessible and malleable. Acknowledging these different perspectives, needs, priorities, and qualities of the same data asset is a first step in forming a data road map. Unfortunately, competitive tension between these drivers can slow insurers from delivering an effective data value program. If the characteristics are viewed independently, or developed without regard to the other needs, execution of a data strategy will stumble.

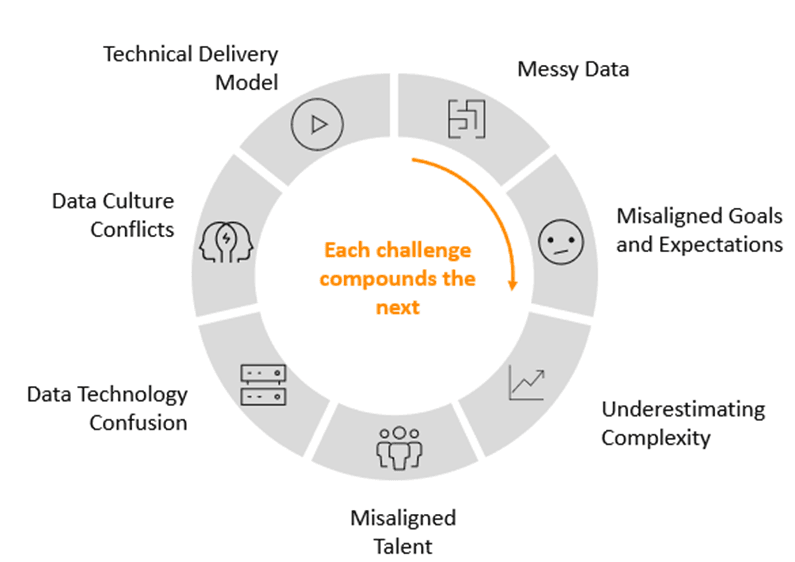

Oliver Wyman and Celent research has identified seven key factors that inhibit successful execution of a growth strategy. Some of these are technical, but most stem from organizational and cultural challenges in business and technology. These are summarized in the figure below ...

With the tsunami of data available, insurers have a significant opportunity to leverage the expanding data assets they own and can access. For many life insurers, the historical lack of business investment in data means that charting the course to achieve this transformation is fraught with obstacles that can jeopardize the voyage.

As insurers build their business data strategies, they must understand the perils and respond to the challenges that can impede progress.