銀行業界において、ローコードはますます重要なトピックになっている。テクノロジー部門の能力が限定されていることから、必要性があるにもかかわらず商品の改良や強化への取り組みが縮小あるいは中止されたり、ロードマップすら作成されないこともよくある。一方、大手銀行にとって既成の商品の購入は必ずしも魅力的ではない。こうした状況を受け、プロセスの管理を維持しながら、アジリティの向上と部門横断的な協調を実現するローコードのツールと技術への関心が高まっている。

これは、カード以外の決済処理において特に注目を集めており、いくつかの銀行はすでにテクノロジースタックの一部の分野においてローコードを利用している。実際に、検討中の実証ポイントやユースケースの数は増えている。背景には、ローコードのメリットが現実的で実現可能であるという概ね一致した見方がある。明らかなユースケースとして、デベロッパーが比較的単純なソフトウェアを変更するために必要な時間が短縮される可能性があり、必要なインターフェイスを作成することで明確な投資対効果が得られる。したがって、複数の銀行がすでにローコードを利用しているか、近い将来の利用を計画している。

この問題をより詳細に調査するために、セレントは欧州と北米のTier 1銀行を対象とする一次調査という重要なプログラムを実施した。この調査は2023年6月から7月にかけて行い、これらの地域の銀行のシニアエグゼクティブ74名から回答を得た。目的は、ローコードに関する潜在的な機会を各行がどのように捉えているかを理解することと、決済アプリケーションの開発における障害や摩擦について理解することである。

主な調査結果は以下のとおり。

- 欧州と北米のTier 1銀行の61%が、決済事業の利益を維持するのがより難しくなっていると回答している。

- 45%が自社における商品イノベーションを阻む最大の要因の1つとして、デベロッパーの能力不足を挙げている。

- 各銀行では、デベロッパーの人材が制約されていることが原因で、過去2年間において決済商品の強化が実現できなかったことが平均3~4回あった。

- 一致した見解として、逸失利益である機会コストは年間の決済収入の5.3%に相当するという回答が示された。

- 36%がカード以外の決済事業をサポートするために、ローコードのツールと技術をある程度利用している。

ローコードに関しては、進むべき道が少なくとも大まかには明確になっているようだ。市場の大半では、ローコードに関する機会について調査が行われており、いくつかの大手銀行はすでにローコードのツールと技術を積極的に活用している。しかし、従うべき唯一の「正しい」アプローチというものがないため、ローコードを通じて商品、サービス、業務に価値をもたらす機会は各銀行によって異なるだろう。

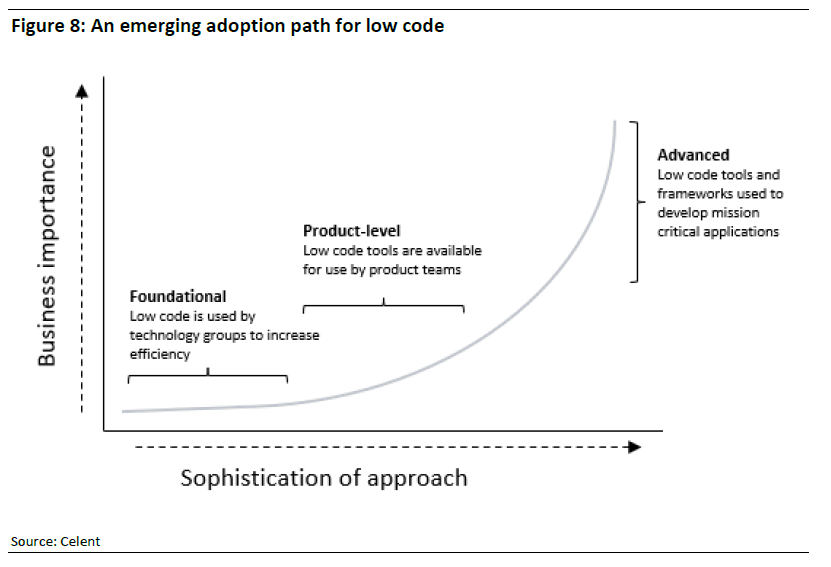

決済処理におけるローコードの使用は比較的初期の段階にあるが、導入の道筋が生まれている兆候がある。現在のユースケースと考え方は3つの異なるカテゴリーに分類することができるが、それぞれが事業への影響を高めており、また、異なるレベルの精巧さを示している (または必要としている) 。3つのアプローチはそれぞれ独立して導入することができるため、これらを段階的なプロセスと考える必要はない。実際に、商品部門や業務部門でローコードのツールやインターフェースを利用できるようにする前に、まずはテクノロジー部門にローコードの効果をもたらすことに取り組む銀行も出てくるだろう。