Market forces and regulatory mandates are changing the way financial institutions operate. Channel diversification and customer expectations mandate digital solutions that legacy systems cannot deliver. Regulation in the banking sector requires that financial institutions provide data to service entities that are essentially competitors. Controlling these interactions is a new requirement for most existing systems.

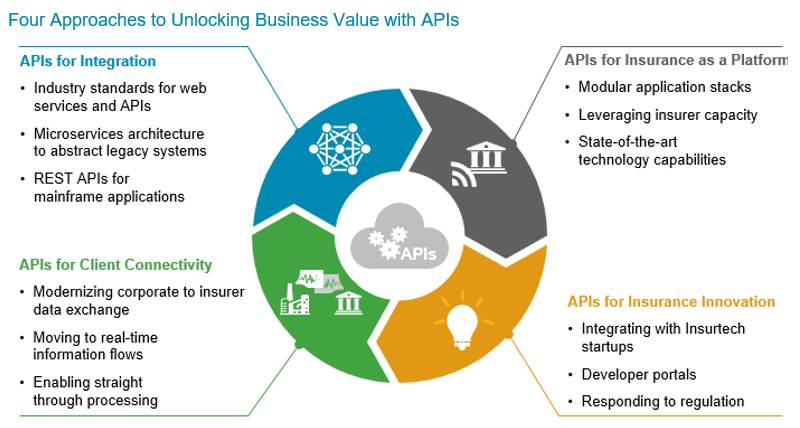

Application programming interface (API) technology provides welcome solutions. Some insurers have led the way in adoption and are experiencing the benefits of increased speed to market, decreased costs, and improved customer experiences.