The Greatest Risks Impacting Treasury and Finance Organizations

The Association for Financial Professionals (AFP) recently published its 2018 AFP Risk Survey Report. The survey, supported by Marsh & McLennan Companies (Celent’s parent company), provides a snapshot of the challenges organizations face in the current risk environment. Responses from 614 senior-level corporate financial professionals around the globe formed the basis of the survey.

Corporate practitioners rank strategic risks (which include competitor and industry disruptions, among others), as the top risks impacting their organizations. Over half (52 percent) report that cybersecurity risks need to be watched closely.

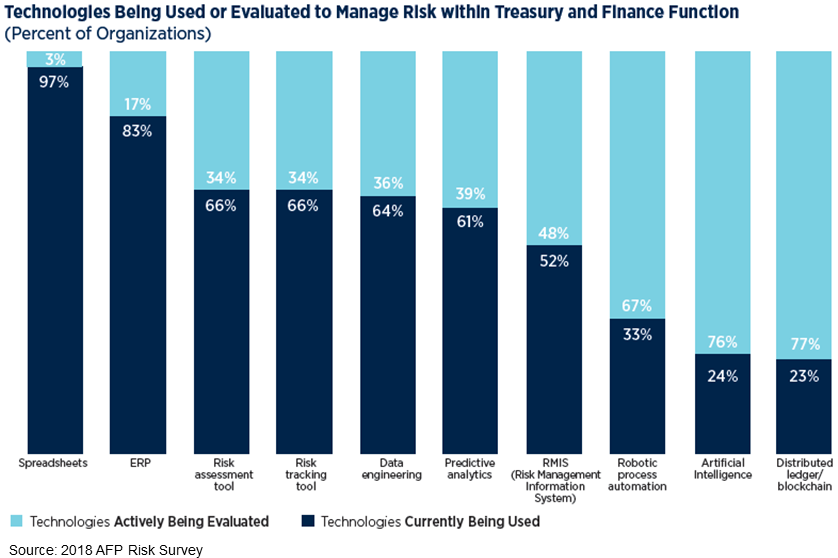

As an analyst in Celent’s Corporate Banking practice, much of my research focuses on treasury and cash management technology. With this lens, I was surprised by the report finding that 97 percent of survey respondents continue to use spreadsheets to evaluate or manage risk.