労災保険の実績はこの半世紀で最高となっている。モノライン保険会社は、他の取扱商品を活用しているマルチライン保険会社からの大きなプレッシャーにさらされている。そしてマルチライン保険会社は積極的に市場シェアを獲得しようとしている。しかし保険業界に現れたトレンドは、新たに出現したリスク[1]、直販ディストリビューション、および従業員の高齢化である。労災保険会社はこれらのトレンドについてどのように考えるべきか、そしてデジタルのどの分野に投資して変革を行い、避けられない将来の低迷に備えることができるか?本レポートでは、労災保険に影響を与えているいくつかの戦略的課題を明らかにし、デジタルトランスフォーメーションが既に行われている分野と将来の予測について述べる。

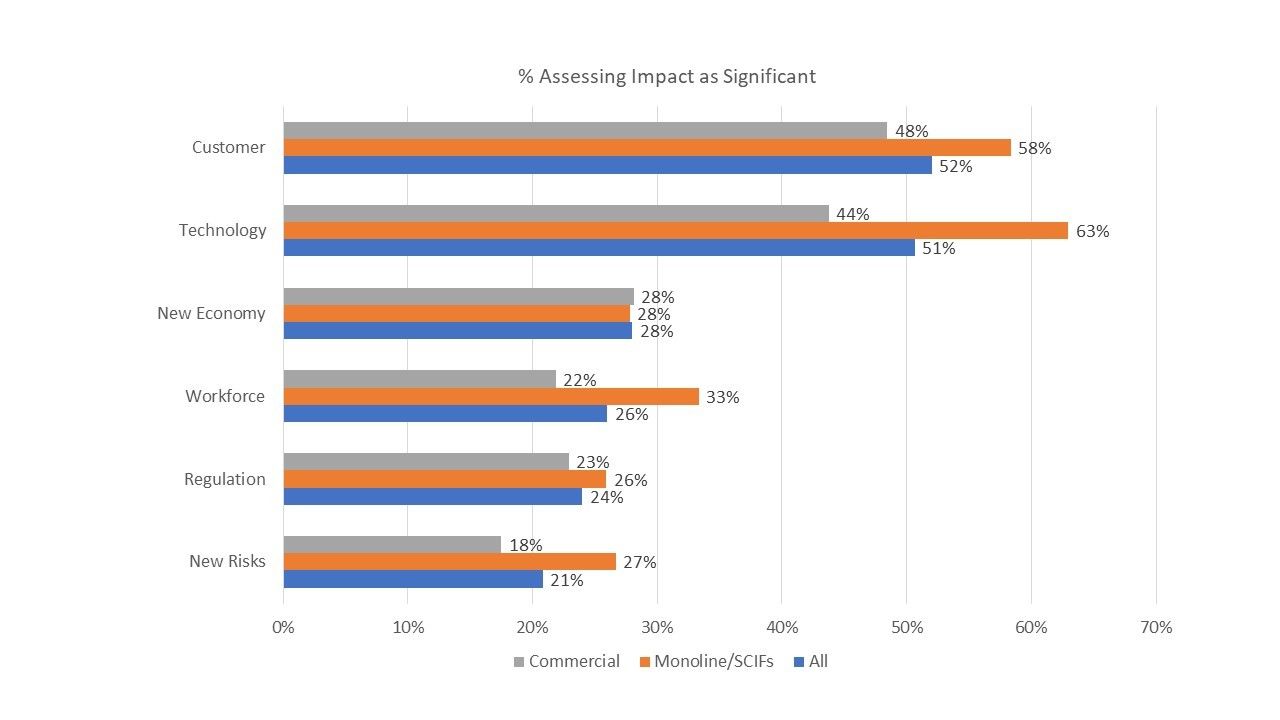

今後の見通しを探る労災保険会社は、変化する顧客期待と、その結果として生じる顧客期待への重点的取組みが、来るべき変化のうち最も効果的なものであるとわかるだろう。このような変化およびテクノロジーがもたらす効果のために、多くの労災保険会社は自らのケイパビリティを見直しているが、難しい課題だと感じている。

保険会社は、引受、保険金請求および不正請求の処理能力についてはかなり自信を持っているが、多くの保険会社はデジタルトランスフォーメーションを管理しつつ独自のカルチャーを変えることは難しいと感じている。

そしてモノラインの保険会社や国家補償保険基金(SCIFs)は、変化の難しさをより痛切に感じている。問題は、労災保険に影響を与えている変化が、他に頼る取扱商品を持たないモノライン保険会社/SCIFにとって効果的であるか、そして労災保険の世界の深い理解に基づいているかということである。

[1]:本調査はCOVID-19感染拡大以前にリリースされた。

(詳しい情報は、セレント北川俊来TKitagawa@celent.comまでお問合せください)