A2A payments will offer more choice for consumers; however, the cards and card-based digital tokens are not going away any time soon.

The Second European Payment Services Directive (PSD2) has laid the ground for third parties licensed as Payment Initiation Service Providers (PISP) to initiate payments directly from the customers’ bank accounts. There is a palpable excitement in Europe that instant bank account-to-account (A2A) payments can be used for shopping, particularly online, and potentially even in physical stores.

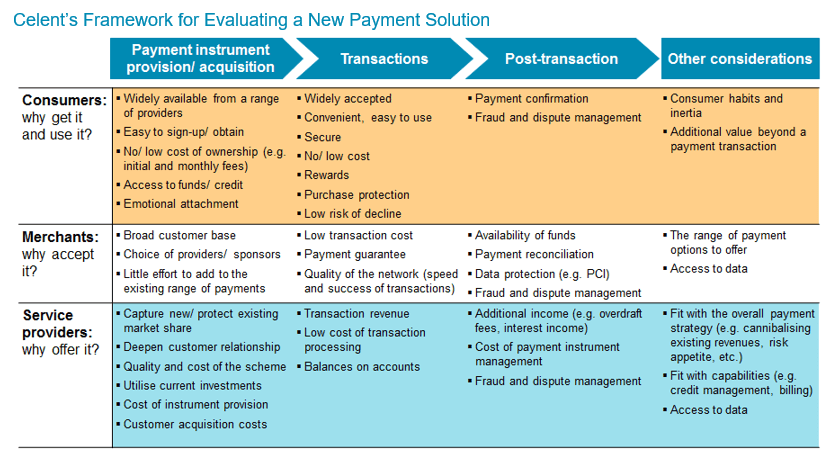

We agree that A2A payments can be a realistic option for consumers when shopping. Yet, we also think that there several barriers that need to be addressed for A2A payments to succeed, particularly in markets where cards have a strong market share today.

This report explores the relative advantages of A2A and card-based payments. It also discusses what needs to happen for A2A payments to effectively compete with cards.