FIS Credit Processing: Helping Community Banks and Credit Unions Grow Their Credit Card Portfolios

22 July 2019

Abstract

On July 8, 2019, FIS briefed Celent on its US Credit Processing solution. This briefing note summarises our key takeaways.

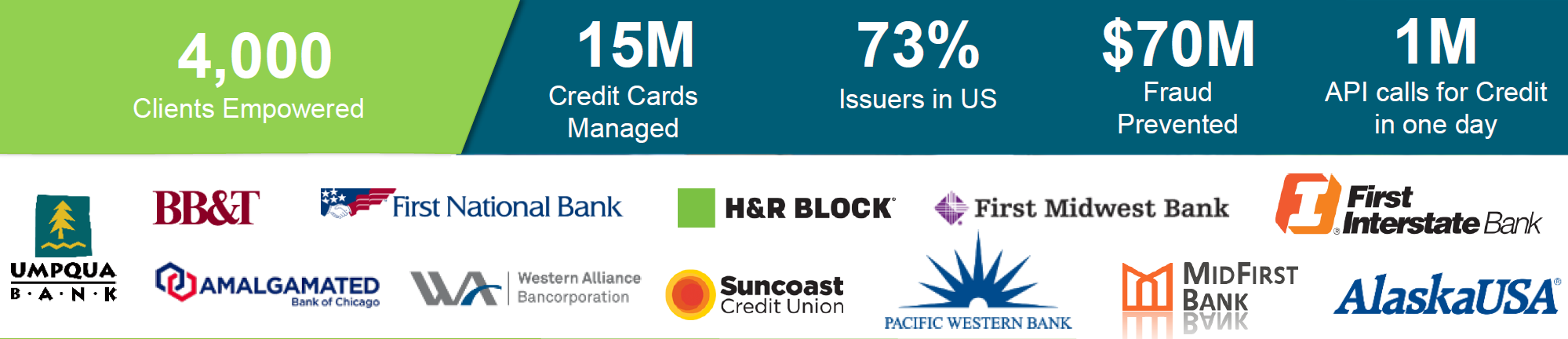

FIS Credit Processing, the credit card processing arm of FIS, appears to be well placed to further penetrate a growing segment of the US credit card market - community banks and credit unions:

- FIS’ investments into digital, self-service, and analytical tools to enhance the cardholder experience and the financial institution (FI) client’s profitability are solid tactics to counter the difficulty of differentiating on core card processing.

- We also liked FIS’ “customer first” approach and its internal efforts to coordinate and make it easier for FIs to introduce new features.

- The impending merger with Worldpay will increase the client portfolio by adding the former Vantiv’s issuer processing client base. It should also enable FIS to further develop existing services (e.g., rewards redemption) and launch new ones, such as POS financing. Given how difficult it is to develop such end-to-end propositions, we will be watching the developments in this area with special interest.