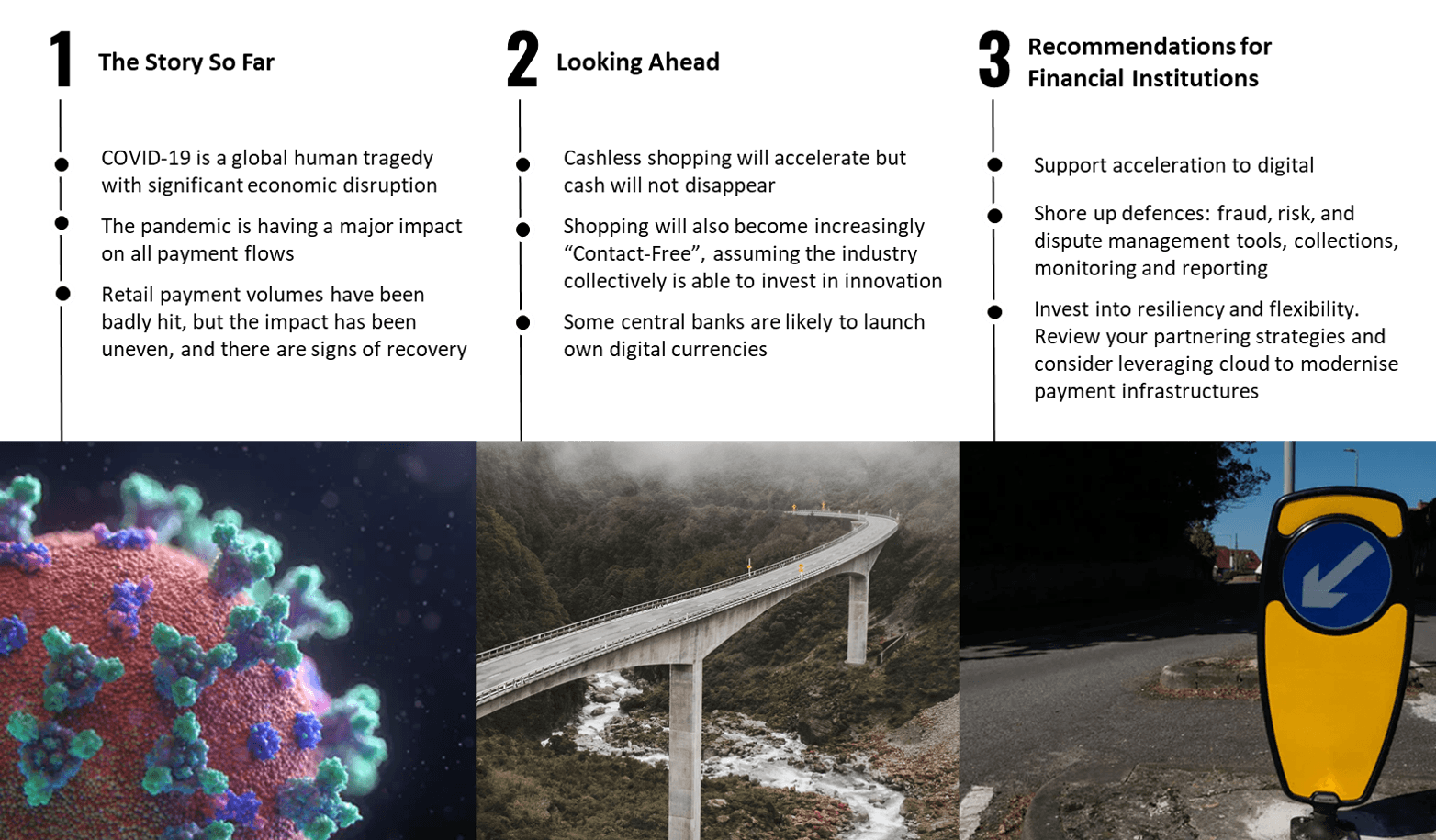

COVID-19は地球規模の人類の悲劇であり、経済にも大きな混乱をもたらしている。決済も例外ではなく、パンデミックの影響を免れた主要決済フローは存在しない。リテール決済量は大きな打撃を受けたが、COVID-19の影響は一様ではなく、幸いなことに回復の兆しが見られる。

本レポートでは、COVID-19パンデミックが決済業界に与えた影響を検証し、今後の展望について考察している。顧客が「非接触」のデジタル決済を求めることにより、現金は消滅するだろうか?中央銀行は独自のデジタル通貨を導入するだろうか?

セレントの見解では、パンデミックにより決済のデジタル化が加速し、金融機関はデジタル・オンボーディング/ 発行からサービスや商品のイノベーションまで、デジタル化をサポートしなければならない。また、不正行為、リスク、紛争管理ツール、回収、監視、報告機能をアップグレードすることにより、防御力を強化しなければならない。更にパンデミックにより、回復力と柔軟性の必要性が明白になった。金融機関は提携戦略を見直し、クラウドを活用した決済インフラの現代化を検討すべきである。

(詳しい情報は、セレント北川俊来TKitagawa@celent.comまでお問合せください)