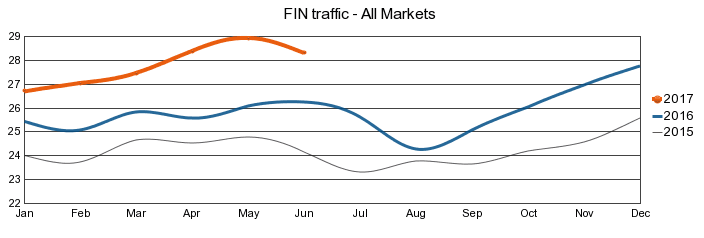

The SWIFT network has long been the backbone for global financial messaging. The cooperative utility was founded in 1973 by a consortium of banks, going live with its messaging services in 1977 to replace the Telex technology widely used in the industry. And there’s still life in the old guard. On May 31, SWIFTNet processed 15.34 million Payments messages, a new daily peak.

source: SWIFT website

| Facing increasing competition from a slew of non-bank fintech competitors, SWIFT went live earlier this year with the first phase of its global payments innovation (gpi) platform including faster use of funds, transparency of fees, end-to-end payments tracking, and unaltered remittance information. The first banks to go live included ABN AMRO, Bank of China, BBVA, Citi, Danske Bank, DBS Bank, Industrial and Commercial Bank of China, ING Bank, Intesa Sanpaolo, Nordea Bank, Standard Chartered Bank and UniCredit. In total, 110 leading transaction banks have signed up for gpi with more expected to join. |