This week I’m in Singapore, which provides a beautiful backdrop for Sibos 2015, the annual conference that brings together thousands of business leaders, decision makers and topic experts from a range of financial institutions, market infrastructures, multinational corporations and technology partners.

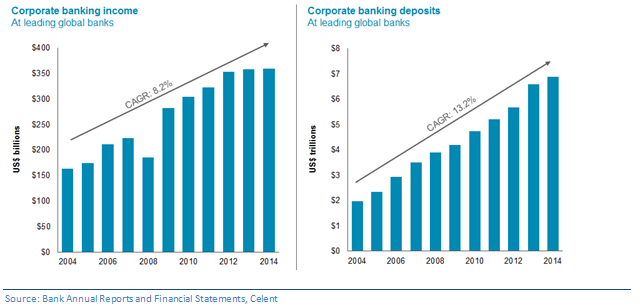

This year’s conference theme is connect, debate and collaborate and takes place at a time of increasing headwinds from a slowing global economy, higher compliance costs, increasingly global corporates, and competition from both banks and nonbanks alike. I spent the past few months taking a deep dive into corporate banking performance over the past 10 years--a period of both tremendous growth and unprecedented upheaval. As expected, corporate banking operating income and customer deposit balances have experienced healthy growth rates over the past 10 years. But surprisingly, despite increases in customer deposits, corporate banking income was largely stagnant over the past few years.

Corporate banking plays a dominant role for the largest global banks. In 2014, corporate banking was responsible for 33% of overall operating income and 38% of customer deposits across the 20 banks included in this analysis.

As outlined in the new Celent report, Corporate Banking: Driving Growth in the Face of Increasing Headwinds, this critical banking sector is shaped by four external forces: economic conditions, the regulatory environment, business demographics, and financial technology. These same factors are slowing corporate banking growth and creating an environment in which banks are overhauling client offerings in the face of regulatory pressure, re-evaluating geographic footprints in response to shifting trade flows, and investing in technologies to ensure a consistent, integrated customer experience.

Much of the discussion at Sibos is on exploring transformation in the face of disruption. As they look to an unsettled future, corporate banks that are flexible, adaptable, and creative will be the ones that succeed. Changing time-tested ways of doing business is painful, but critical for future success.