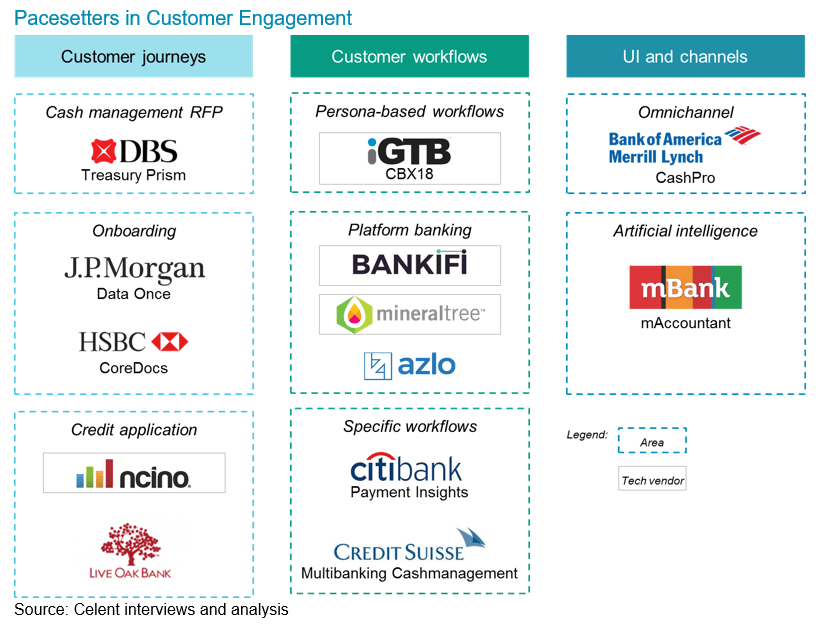

Bank customer engagement needs to evolve if banks are to remain competitive with alternative providers. Pacesetters are leading the charge by transforming the engagement model, adopting new channels and user interfaces, and investing in intelligence.

Excellence in customer engagement has become paramount for commercial bankers. A confluence of forces is pushing the engagement bar up: customer touchpoints are multiplying, demand for real-time data and transactions is growing, and nimble digital competitors are vying for revenue share and threatening select banking services with obsolescence. Underperformance could lead a bank to be relegated to commodity parts of the value chain, for example, data custodian and payment processor. Outperformance leads to greater share of wallet and new revenue streams.