Retail bank technology spending across Asia Pacific region has grown steadily in 2023. While some of the specific drivers behind this growth vary between country and financial institution, the common themes are centred around product development and investing in the capabilities for greater agility. Closely linked is the emphasis on enhancements to the customer experience in key areas such as onboarding, while also exploiting opportunities in areas such as embedded finance and BaaS.

The emphasis placed on agility is common across most major markets, and it's no surprise to see banks across Asia Pacific also focusing here. There are many reasons financial institutions are investing in new capabilities this area, but one of the most important is the cultural change that has been catalysed by the growth of the fintech sector. Banks are increasingly open about their desire to become more responsive and nimble, and most recognize that they need to adapt their approach (indeed the leaders are already on this journey). The pace of adoption of cloud technologies, surge in activity around AI, and investment in open ecosystem projects all highlight the scale of this shift in attitudes.

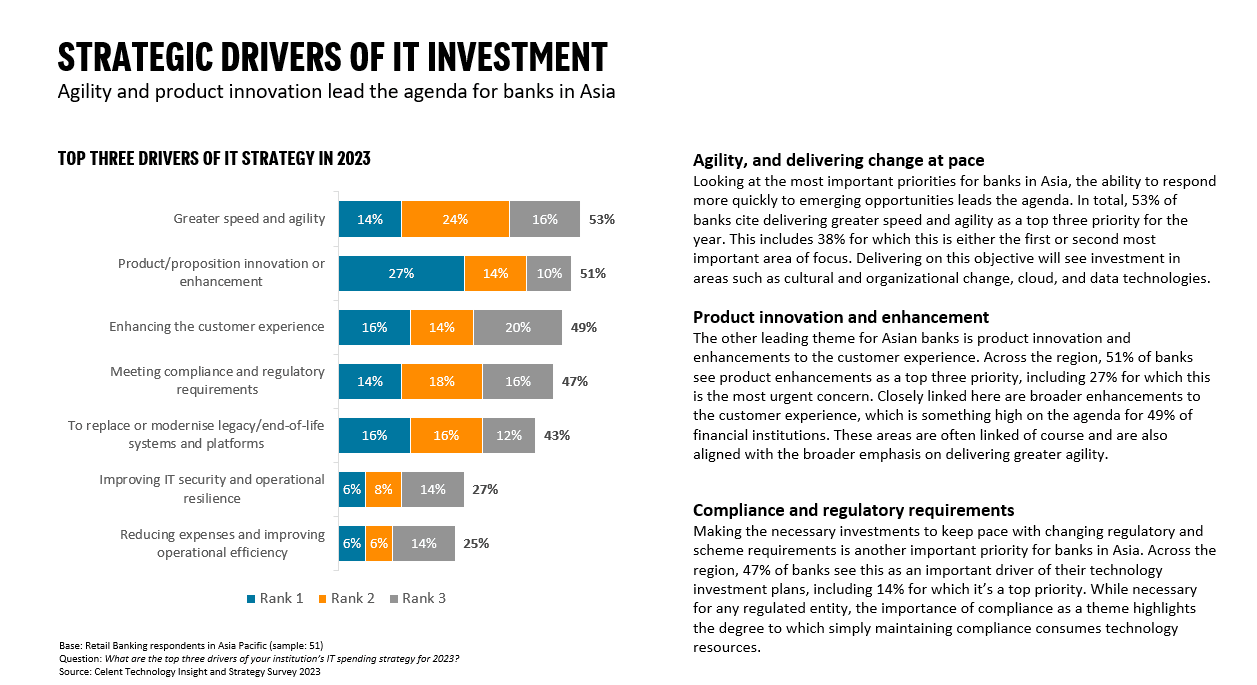

Some of the key findings from this research include:

- 75% of retail banks in Asia Pacific report that the competitive threat from fintechs and challengers is increasing.

- 53% of banks in cite delivering greater speed and agility as one of the three most important drivers of their current technology strategy.

- Technology budgets are growing. IT spending has grown by 4.3% on average in 2023, and sentiment is positive about budget growing by a greater amount in 2024.

- 51% of banks are investing in improvemenst to their digital account opening capabilities as a key initiative.

- 45% of banks are currently exploring use cases for Generative AI technology at the moment, while a further 25% have projects related to this technology on their roadmap for 2023/4.

The message for the industry is clear. As technology investment grows across the region, and banks enhance their capabilities in areas such as digital onboarding and organisational agility, those that do not keep pace with these changes risk being left behind.