Achieving Next-Generation AML: Overcoming Challenges for Smaller Financial Institutions

19 June 2019

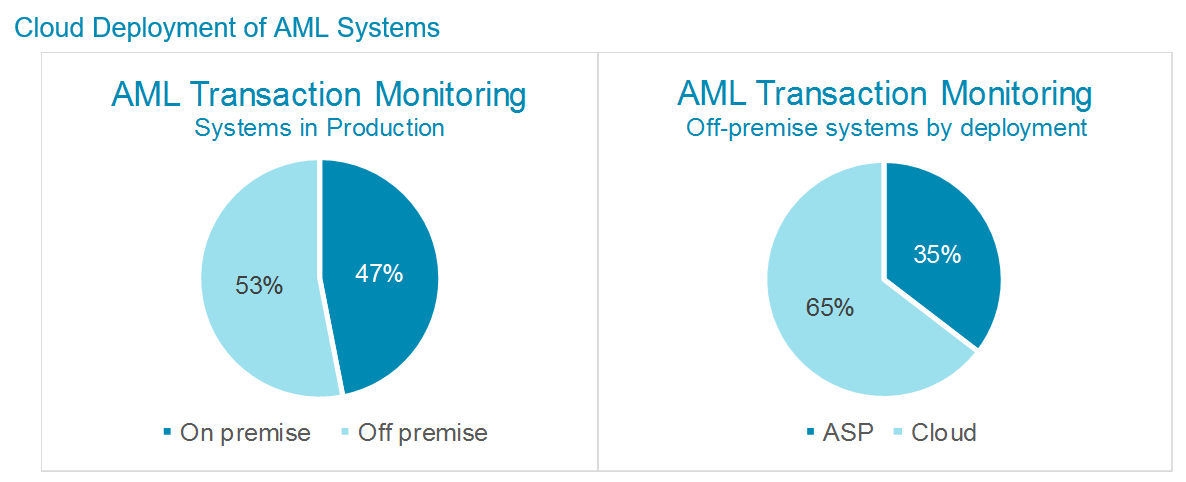

For smaller financial institutions, cloud-based delivery of advanced solutions may provide the way forward to next-generation technology in AML compliance.

Key research questions

- What limitations do smaller financial institutions have in sourcing AML technology?

- What are the use cases for next-generation technologies in AML compliance?

- What factors are supporting the adoption of next-generation technologies in AML compliance?

Abstract

Smaller banks have limited resources and budgets to support AML compliance.

Constraints on anti-money laundering budgets and resources perpetuate a divide in AML capabilities between large financial institutions and smaller firms. While large banks have typically invested in maintaining and upgrading powerful AML solutions and robust model development initiatives, firms with smaller teams have often relied on less sophisticated, older systems and vendor-supplied rules.