Countries and regions around the world are implementing advancements in financial market infrastructure (FMI) at an accelerated rate. These efforts go beyond initiatives to offer 24/7, real-time, payment infrastructure, evolving into an area of innovation for next-generation financial services via the provision of value-added services.

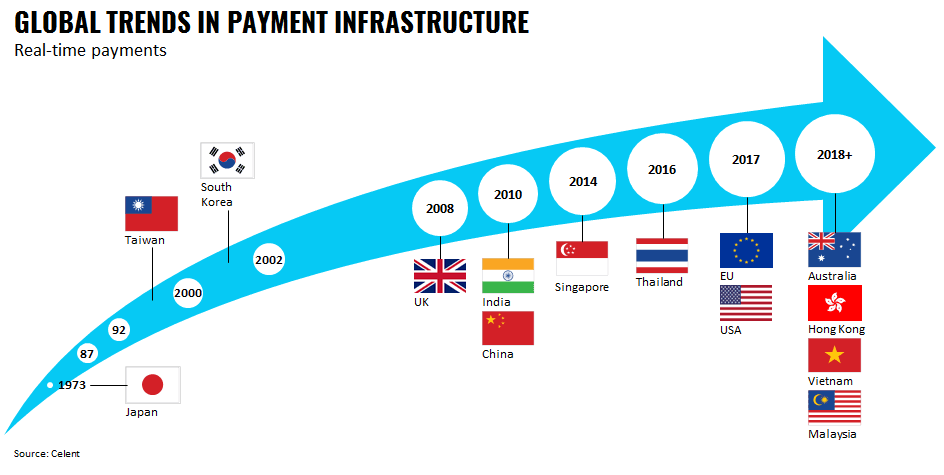

Japan was ahead of the game when it launched the first iteration of the Zengin System in 1973, realizing real-time payments—albeit limited to weekday daytime operation. Some 45 years later, the Zengin More Time System, launched in October 2018, made real-time payments possible around the clock. Likewise, other markets have updated payment infrastructures to support both real-time, around-the-clock payments with the UK, doing so in 2008, and North American and major European countries and regions following suit by late 2017.

This series of reports is based on Celent's payment taxonomy and adopts four perspectives to examine Japan’s payment infrastructure: (A) payment instruments and channels, (B) corporate payments (wholesale payment services, large-value services), (C) retail payments (retail payment services [including retailers] and small-value payments services), and (D) the current state of the financial market infrastructure (FMI). As a backdrop to the payment services landscape and the competitive situation, Part 1 of this series examined1 the Zengin System (Japanese Banks' Payment Clearing Network) and Part 2 undertook2 an examination of the Bank of Japan Financial Network System (BOJ-NET).

Part 3 of the series focuses on corporate payments, namely large-value payments and wholesale payments, and examines advances in payment infrastructure, promising new technologies, and emerging service providers coupled with the relationship between the inherent new value and related risk. In addition, Part 4 of the series will examine the diversification of payment instruments and channels and retail payment services (with an emphasis on trends in small-value and retail payment services), coupled with an analysis of new operators and technology usage. In a nutshell, firmly embracing the perspective of the customer is essential to generate disruptive payment services that transcend the limitations inherent in the competitive context of the FMI and regulatory systems.