Traditional technology used in financial crime compliance operations has reached an impasse and cannot handle growing volumes and complexities. Effective compliance will require more intelligent solutions and automated workflows.

This report discusses the potential of advanced analytics such as artificial intelligence, machine learning, and robotic process automation in AML operations.

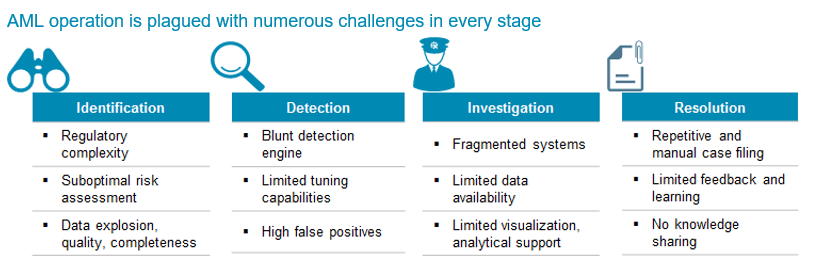

Rules-based technology and siloed operations are proving to be inadequate in detecting hidden risks, and financial institutions are drowning in alerts that mainly deal with “spot checks” instead of profiles or events. Flood of false positives and heavy reliance on manual processes are making AML programs costly, inefficient, and unsustainable.