グローバルな貿易は商取引によって文化と地域のつながりを育み、人類文明の原動力となってきた。銀行は、貿易・サプライチェーンファイナンスエコシステムにおいて重要な役割を果たしており、法人顧客と緊密に連携してカスタマイズされたソリューションを提供している。しかし手作業の負担が重くのしかかり、大量のペーパーワークや書類に追われ、非効率的でコストを押し上げるミスが発生している。

オープンアカウント取引は柔軟かつシンプルで、複雑な書類や金融仲介機関を必要としない。しかし、不払いや支払い遅延などのリスクも伴うため、関係者はこうしたリスクを慎重に管理し、緩和する必要がある。トランザクションバンキングの世界的リーダーであるBank of Americaは、戦略的な理由から、一部の顧客にオープンアカウントプロセスを提供してきた。同行の推計によると、同行はオープンアカウント商品の顧客についてこのプロセスを促進するため、年間約400万枚の書類を窓口で受け取っている。このソリューションをデジタル化しようとする業界の試みは、これまでほとんど成功してこなかった。その主な理由は、サプライチェーンの参加者間のデジタル導入のレベルが様々であり、テクノロジーコストがかかることである。

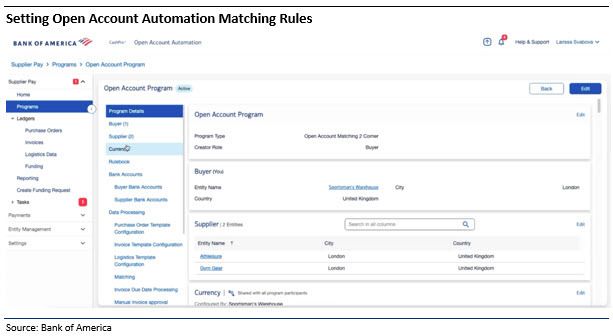

Bank of Americaは、Open Account Automationソリューションにより法人顧客向けの貿易・サプライチェーンファイナンスを再構築した。Open Account Automationは、顧客がより迅速かつシンプルにオープンアカウント取引活動を管理するための方法である。書類からデータを取得してデジタル化する高度な処理プラットフォームを搭載しており、分散型台帳技術とクラウド技術を使用して、ほぼリアルタイムの照合と当事者間の情報交換を推進する。

このソリューションは、手作業によるプロセスを最小限に抑え、照合と承認にかかる時間を数週間から数分に短縮し、調達から支払いまでのメリットを実現することができる。