The economic shocks of 2022 and early 2023 appear to have calmed, but geo-political and financial conditions remain far from easy for banks and their corporate clients.

For banks, the windfall gains from net interest margin are eroding as corporate clients demand more yield from deposits. Banks are burdened by compliance challenges but need to become more agile and deliver solutions faster. For corporates, the cost of borrowing continues to rise, and managing liquidity remains a top challenge.

In a year of falling fintech valuations, some open banking risk management issues, and a transfer of deposits to larger institutions, the innovation pendulum looks to be swinging toward larger banks with higher budgets and sound risk frameworks.

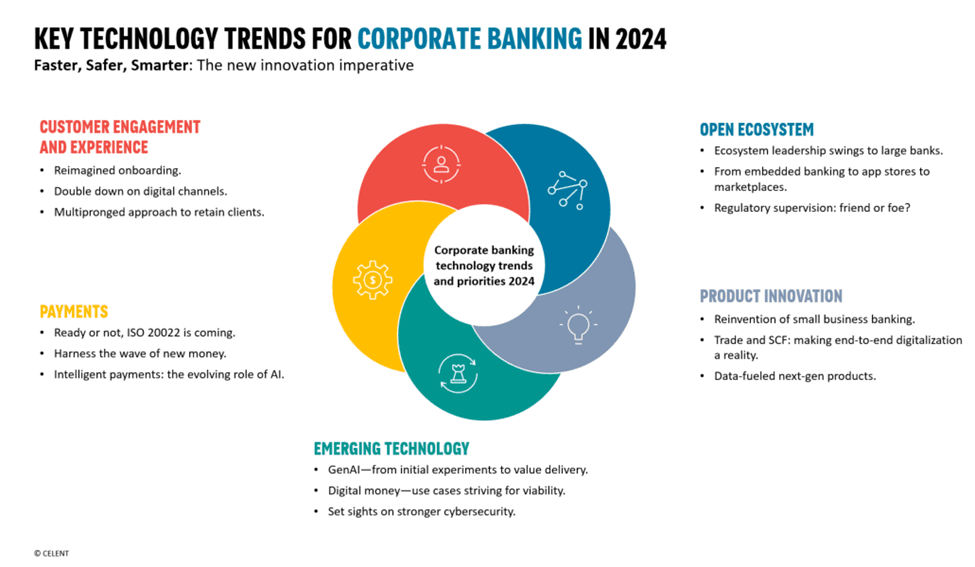

The good news is that IT spending for banks around the world is set to grow into 2024 and beyond. Technologically, the promise of generative AI (Gen AI) caught the limelight, bringing both opportunities and concerns for banks. Larger banks have a latent ability to capitalize on their investments in platforms, data, and AI. If they can harness it, they will have a “large mover advantage” in AI and embedded finance. While much uncertainty remains in 2023, corporate banking technology priorities for 2024 and beyond are becoming clear.

Celent’s guidance to clients is around five key industry themes and 15 corporate banking technology priorities for 2024 and draws on some of our recently published insights, but much of the content is new, published here for the first time.