While the terminology “direct indexing” is newer, the investment approach is by no means new, as separately managed accounts (SMAs) can and have taken this approach for UHNW and some HNW individuals for decades. The revitalization of this investment approach is driven by improvements in the sophistication of algorithmic portfolio construction techniques, coupled with zero commission and fractional share trading, to enable the industry to deliver the investment approach to investors of all asset sizes. Direct indexing is an attractive proposition to meet demand around investors’ hyper-personalized needs, which is primarily being driven by NextGen (millennial and Gen Z) investors as well as the industry’s heightened focus on socially responsible investing (SRI).

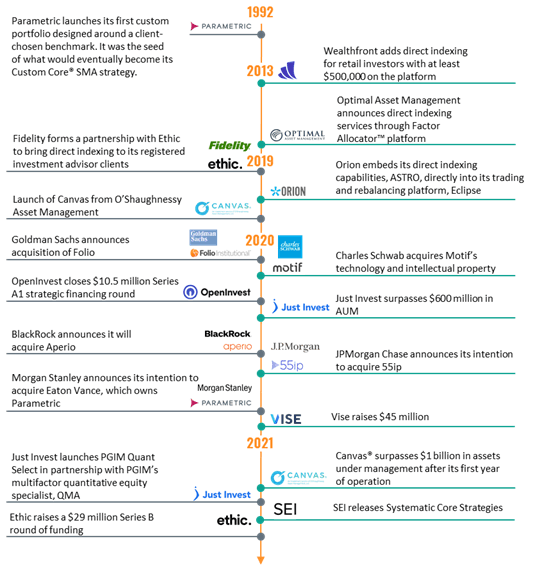

The industry’s evolution to adopt direct indexing is backed by blockbuster M&A deals in 2020, with BlackRock acquiring Aperio for $1.05 billion and Morgan Stanley acquiring Eaton Vance, which owns Parametric, for $7 billion. In addition to M&A, AUM growth for firms that categorize themselves as direct or custom indexers has captured headlines.

With headline-catching acquisitions and AUM growth comes industry voices prophesizing about the future of direct indexing. Direct indexing has been deemed the “ETF Killer,” “The Great Unwrapping,” and “The Next $100 Billion Advisor Opportunity.” So, is direct indexing the next big thing in wealth management, and will it meet the demand for hyper-personalization? And if so, what are the catalysts and barriers to adoption? Celent explores how the wealth management industry is reacting to direct indexing as well as how certain direct indexing features are delivered and how delivery challenges could create obstacles to larger-scale adoption.