How Digital Are US Retail Banks Today? Celent Digital Panel 8: US Banks and Credit Unions Making Progress

Progress on the Digital Journey.

Key research questions

- What factors drive digital outcomes for banks and credit unions?

- What changed from 2015?

- What digital topics would banks and credit unions like to know more about?

Abstract

Banks are saying the right things on digital, but aren't yet executing it really well.

Our eighth digital panel revisits our inaugural effort, examining North American retail banks' attitudes on digital. They've advanced, but still feel there's work to be done.

Banks and credit unions have reason for cautious optimism. Reponses show a greater C-suite commitment to investing in digital compared to 2015. Customer preferences are increasingly driving decision making, and panelists are eager to learn more about leveraging data and analytics to serve them.

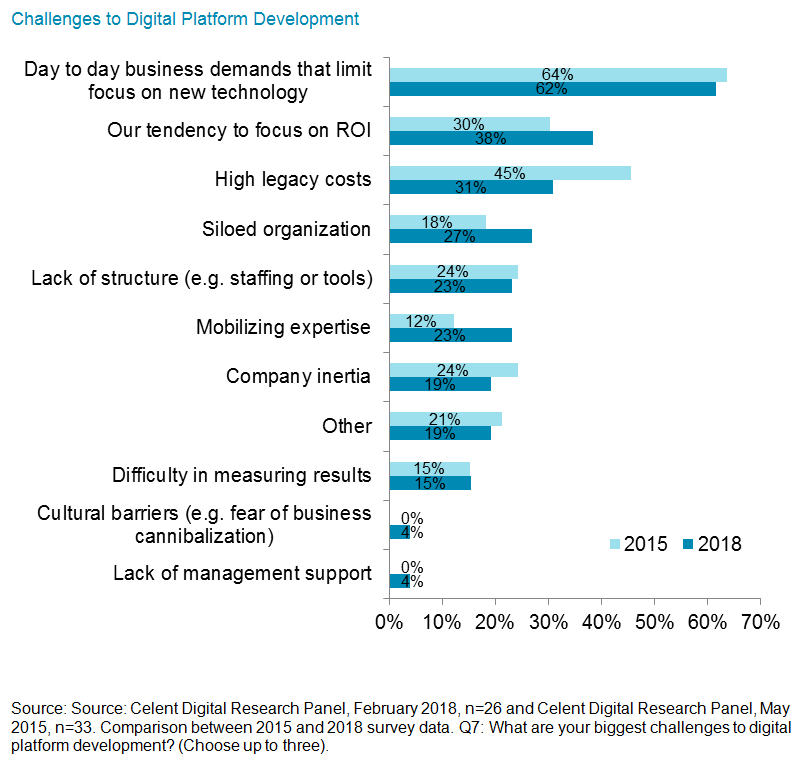

There is still a long way to go, however. Few respondents consider their efforts truly outstanding. Executing on automation and analytics is still a challenge. Balancing the sea change that digital mandates with day-to-day responsibilities is a significant barrier.