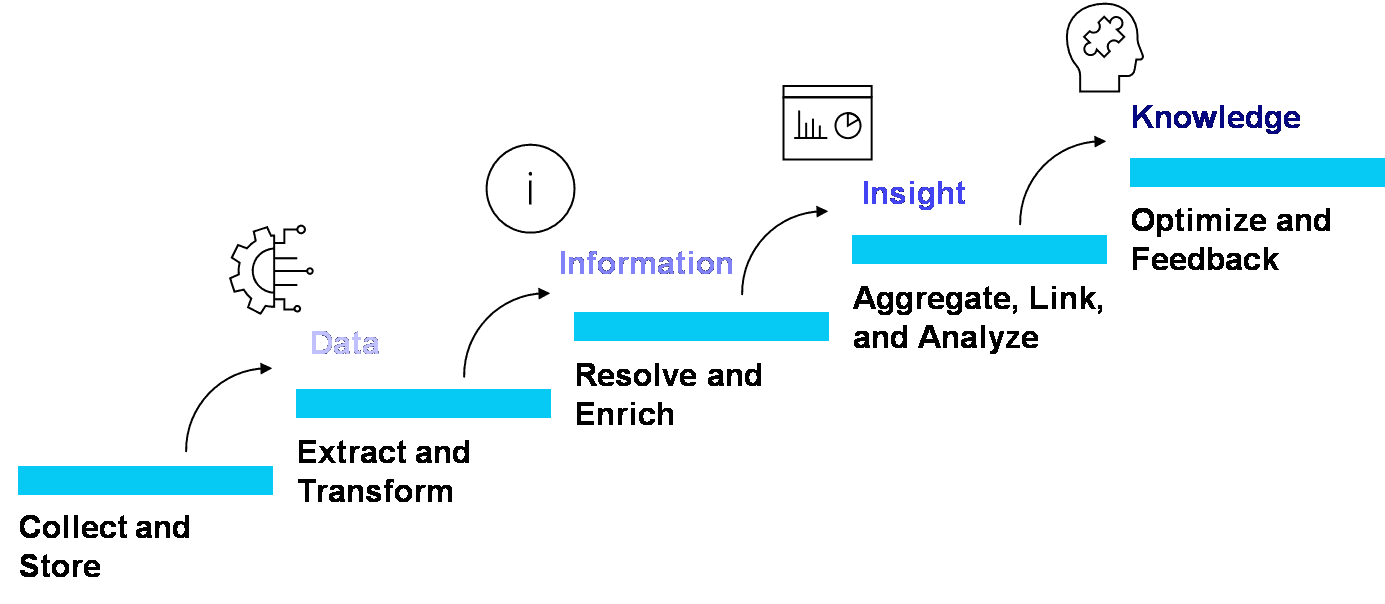

Improving data management is a journey; in recent years many FIs have been ushering in changes to break down data silos and simplify data architecture. They are seeking to increase reusability of data by standardizing data definitions, formats, and normalizing data models across products, business lines, and regions. In this journey, new technology can play an important role because it can automate and streamline data management efforts such as automatically extracting information, imputing missing records, repairing data entry errors, resolving duplicate records, enriching and aggregating information and profiles, file reports, and many others.

Good Data Management Practices Needed To Extract Insights And Knowledge From Raw Data

Source: Celent

Voluminous and better-quality data will be essential fuels for powering artificial intelligence (AI) and machine learning techniques, and they are poised to revolutionize AML operations. Results from early exploration and pilot projects show they can significantly improve efficiency, productivity, and coverage. Risk scoring can be made more effective and responsive to changes in client’s profile or actions that will enable continuous monitoring of risk across a client’s lifecycle.

Operationalizing the pilots into production and industrializing AI will need FIs to rethink their approach to data storage and processing. Advancements in cloud technology are opening new horizons because cloud offers massive data storage and scalability, on-demand high-performance computing, and infinite elasticity. Recent developments in application programming interfaces (APIs) present new avenues for seamless connectivity and workflow linkages. APIs can also automate the interaction between different applications and can help FIs adopt a microservices based architecture.

As new technology opens a world of new possibilities, there will be new challenges facing FIs in the digital era. Data privacy and security issues will be paramount, so FIs will need to strengthen access controls and encryption techniques to safeguard against data loss and data theft. They will also need to rearchitect operational arrangements regarding data hosting and resource localization to comply with a complex patchwork of data privacy regulations. Data governance in the digital era will therefore require additional focus on transparency, oversight, and control frameworks to ensure that data is used responsibly.

This report was commissioned by NICE Actimize, while Celent retained full editorial control.