従来のAMLコンプライアンスのオペレーションとAMLソフトウェアの技術は、行き詰まりを見せています。

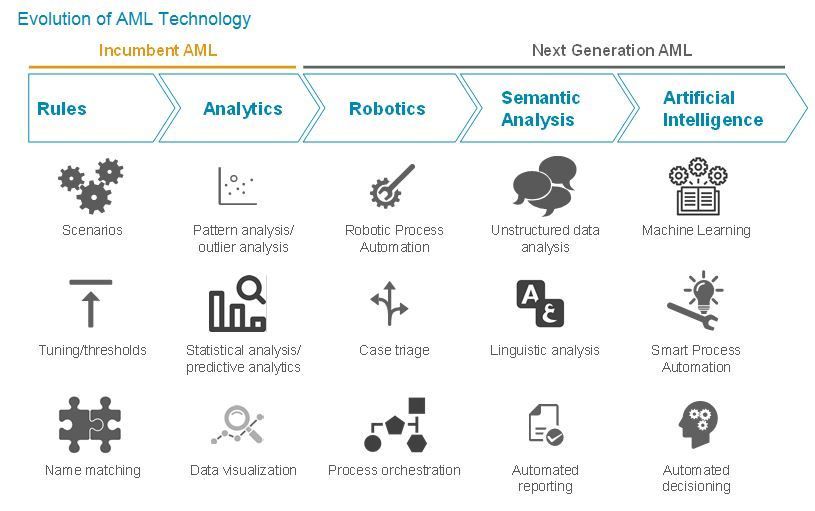

金融機関は、AML業務のさらなる効率化を求め、AIやロボティクスなどの最新技術に関心を寄せています。今日ヒトが下している様々な判断や意思決定は、いずれこうした最新技術によって自動化されるようになるかもしれません。

本レポートでは、AMLとKYC分野におけるビッグデータや、高度なアナリティクス、人工知能の活用、そしてイノベーティブなアプローチを取り上げます。また、革新的なソリューションを提供しているベンダーを30社以上紹介します。

多くの金融機関では、現在直面しているペインポイントに対応するために、既存のAMLシステムに新たな技術を補完的に適用する取り組みが始まっています。例えば行動分析の観点では、ベンダーの分析シナリオを用いる代わりに、取引モニタリングエンジンを用いて高度なアナリティクスモデルを実践しています。またスクリーニングプロセスの強化という観点では、名寄せシステムや、言語分析ソフトウェア、予測分析などを利用することも考えられます。

ベンダー市場に目を向けてみると、高度なコンピューティングテクノロジーを採用したKYCソリューション(スクリーニングとデューデリジェンス)やAMLソリューション(不正行動の監視と検出)を提供する、新しいベンダーが登場しています。こうしたベンダーの中には、急速に拡大するRegTechスタートアップのほか、10年来にわたってこの業界にテクノロジーを供給し続けているベンダーも含まれています。