Wealth management firms use outsourcing as a cost-cutting measure, and adoption has tended to accelerate in times of lackluster market conditions such as the global financial crisis. Fast forward a decade, and many of these costs cutting measures are still relevant as continued headwinds and uncertainty around the long-term implications of COVID-19 consume wealth management firms.

A theme across the industry is COVID-19 as an accelerant to technological adoptions. Almost overnight, wealth management firms had to adjust to remote working situations. For traditional middle and back office operations, this meant management had to be comfortable with security, VPN capacity, team collaboration issues, and digitizing processes that include paper, to name a few challenges. While firms that process these operations in-house have complete control over their decisions and comfort levels, firms that outsource these operations have limited control.

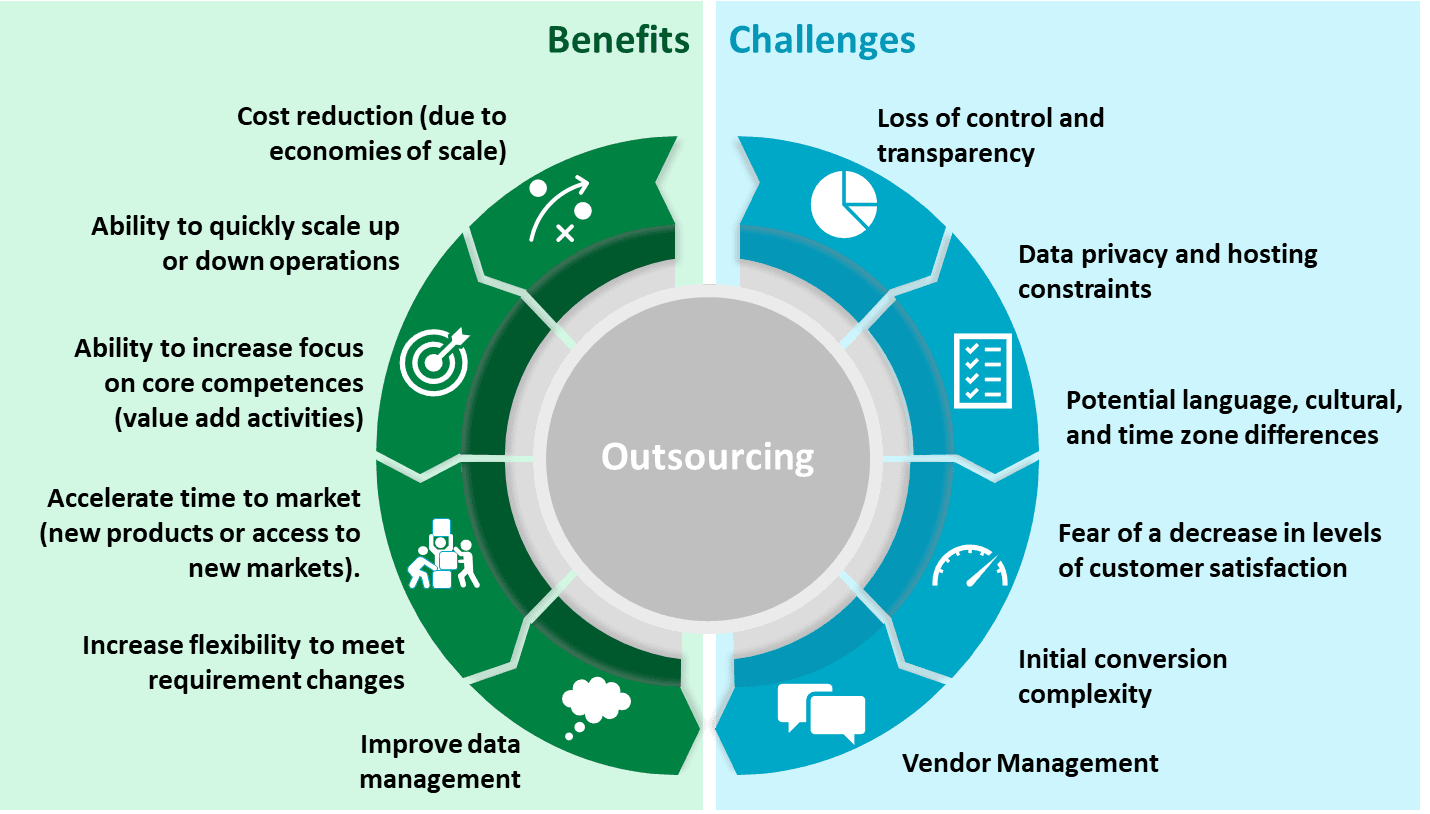

Along with cost reduction, the ability to scale operations and enter a new market or offer a new product quickly is a major attraction of outsourcing. However, adoption is challenged by the loss of control and operational transparency

As the ways in which wealth management firms return to work after lockdowns and social distancing requirements are lifted remains a question, changes to the existing operating model are sure to ensue. Wealth managers are set to “batten down the hatches” when it comes to costs, with an added focus on utilizing resources for value-add operations. Operations not seen as a value-add are on the chopping block, while outsourcing vendors wait for the right moment to strike. As wealth managers take on the difficult task of establishing the new “normal,” they must simultaneously evaluate their options for outsourcing.