With all the press following the Chase mobile RDC initiative, everyone is likely aware of mobile RDC. But, there’s another changing face of RDC that may not be as cool as depositing using one’s cell phone, but one no less important to banks.

In late July, Servant PC Resources announced integration of its Servant Keeper Church Management Software with Heartland Check Management from Hartland Payment Systems. With the Heartland solution, a client simply scans a check from their location using a remote scanner, and the deposit is processed. The client receives automatic notifications and can monitor every step of the deposit in real-time. At that point, the transactions are posted in Servant Keeper format to reconcile all member contributions without manual entry — making it an end-to-end solution. Additionally, the client can elect to have bad checks handled by Heartland’s automated recovery program.

This announcement – and the solution it trumpets – stands in sharp contrast with most bank sponsored RDC solutions in several important ways. Specifically:

It provides solution integration that adds value compared to a stand alone, deposit-only RDC solution offered by virtually all banks.

Banks aren’t doing the selling. In an August 2009 survey of 172 US financial institutions, the majority of respondents conceded that less than 5% of their small businesses were using RDC. Servant PC Resources serves over 22,000 US churches that will now be offered a compelling RDC value proposition as a simple upgrade to software they already use. Vertical market integrations like this offer solution providers (in this case Hartland Payment Systems) instant, low-cost access to strategic target markets. Churches deposit lots of checks.

Heartland performs deposit review and item correction, virtually eliminating the need for users to manually correct poorly captured check amounts, saving them time and improving the user experience.

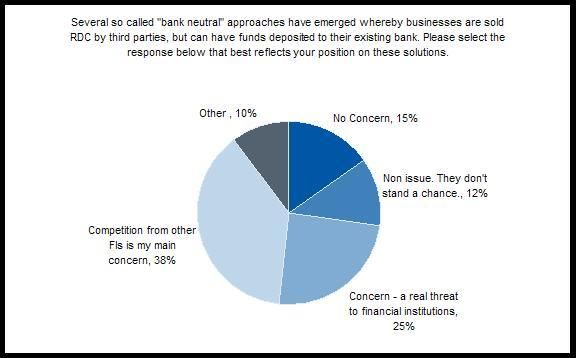

But, banks don’t seem all that concerned about this changing face of RDC. In the same August 2009 survey, only one in four responding financial institutions voiced any concern about the growth of non-bank RDC providers (figure 1).

2. Make it easy to say “yes” with simple and affordable pricing and online enrollment.

3. Get busy selling.