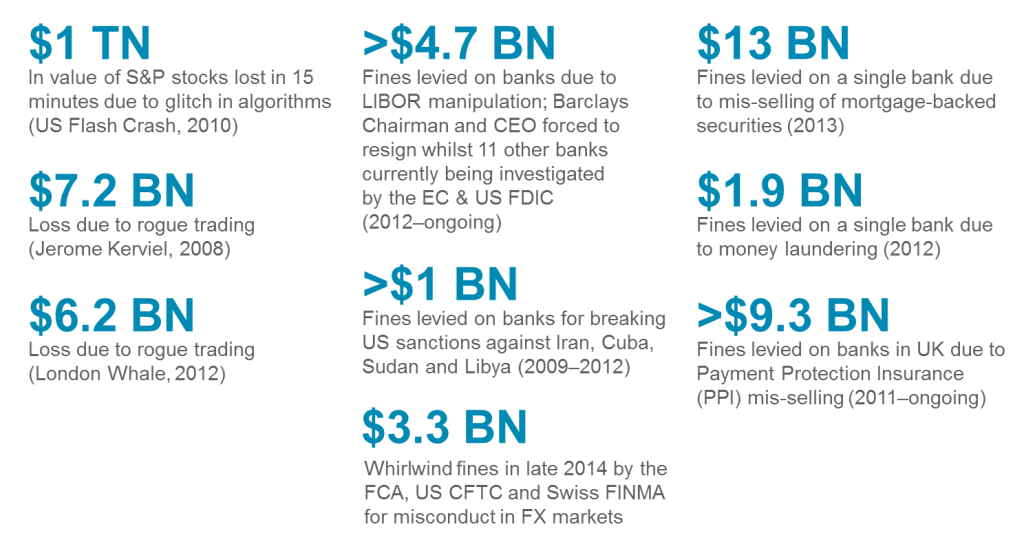

Large financial institutions spent in excess of $25 millionon rolling out failed enterprise risk management frameworks during the 2000’s. So why try again? Well for many obvious reasons, the most notable of which has been the large scale failure of institutions to manage their risks and the well-editorialized consequences of those failures. The scale of fines for misconduct across financial services is staggering and damage to the banking industry’s reputation will be long-lasting. Major Control Failures in Financial Services Source: publicly available data Regulators and supervisors are determined to stop and reverse these risk failures, specifically, the poor behavior of many bankers. Regulators are demanding that the Board and executive management take full accountability for securing their institutions. And there is no room for failure. This is the only way that risks can be understood and, hence, managed across the enterprise. There is no denying that risk management frameworks are hard to implement but Celent believes the timing is right for the industry to not only secure their institutions and businesses but to innovate more safely and, slowly, win back the trust of their customers. My recently published report Governing Risk: A Top-Down Approach to Achieving Integrated Risk Management, offers a risk management taxonomy and governance framework that enables financial institution to address the myriad of risks it faces in a prioritized, structured and holistic way. It shows how strong governance by the Board is the foundation for a framework that delivers cohesive guidance, policies, procedures, and controls functions that align your firm’s risk appetite to returns and capital allocation decisions.

Source: publicly available data Regulators and supervisors are determined to stop and reverse these risk failures, specifically, the poor behavior of many bankers. Regulators are demanding that the Board and executive management take full accountability for securing their institutions. And there is no room for failure. This is the only way that risks can be understood and, hence, managed across the enterprise. There is no denying that risk management frameworks are hard to implement but Celent believes the timing is right for the industry to not only secure their institutions and businesses but to innovate more safely and, slowly, win back the trust of their customers. My recently published report Governing Risk: A Top-Down Approach to Achieving Integrated Risk Management, offers a risk management taxonomy and governance framework that enables financial institution to address the myriad of risks it faces in a prioritized, structured and holistic way. It shows how strong governance by the Board is the foundation for a framework that delivers cohesive guidance, policies, procedures, and controls functions that align your firm’s risk appetite to returns and capital allocation decisions.